Do you have a clearing relationship with another FCM? If so, CQG provides a way for you to:

•Ensure that your traders are anonymous to the clearing firm

•Benefit from a second layer of risk above individual account risk settings

Are you a clearing member of an exchange? If so, CQG provides a way for you to:

•Manage risk for one consolidated account without having to consider individual account risk settings

•Profit from simplified back office processes

CQG is the only ISV able to provide, through the introduction of omnibus accounts, these benefits to our FCM partners.

What They Are

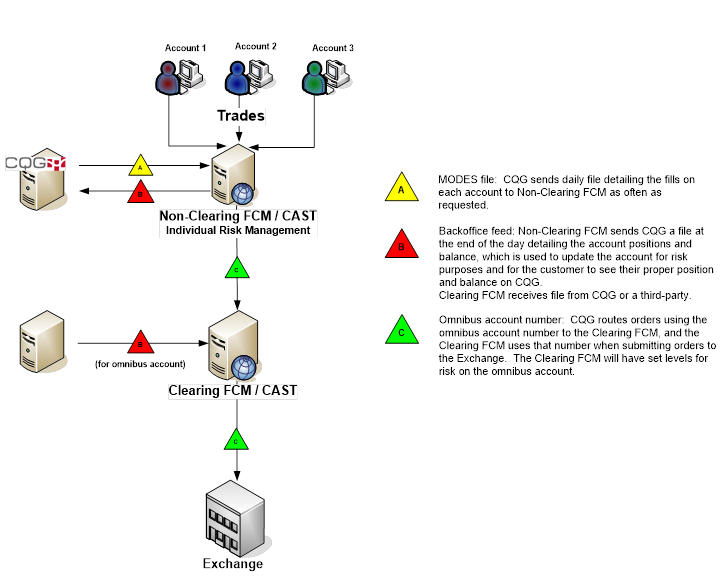

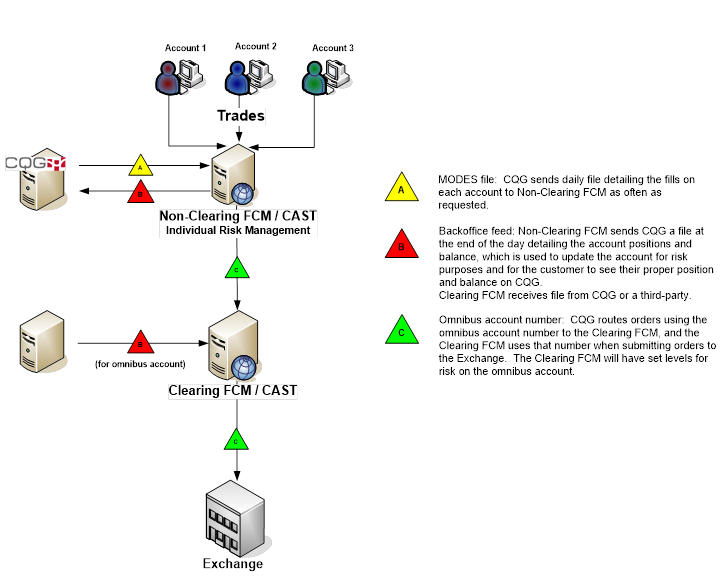

Omnibus accounts, set up by clearing firms for non-clearing firms, are used to funnel orders from individual accounts at a non-clearing firm into one omnibus account at the clearing firm. All orders placed for a particular exchange from those individual accounts are sent to the clearing firm and exchange using the omnibus account.

In this way, customers of the non-clearing firm are not disclosed to the clearing firm.

Non-clearing firms are able to manage risk separately from the omnibus account and can have multiple omnibus accounts with a range of clearing firms.

How They Work

After a CAST administrator establishes the omnibus route, the clearing FCM sets up the omnibus account, making sure to set the location and risk server for the omnibus route. The non-clearing FCM sets up the individual accounts. Traders associated with the non-clearing firm place orders using that firm’s account, and the orders are sent to the clearing firm and exchange using the omnibus account.

Suppose that Firm ABC needs to clear Eurex through Firm XYZ:

•XYZ provides their Eurex ID to be used by ABC to CQG.

•CQG creates an Omnibus Eurex Messenger route.

•In CAST, XYZ creates an omnibus account for ABC, sets the route for the account as Omnibus Eurex Messenger route, and then sets risk for the omnibus account. The individual accounts at ABC cannot place trades beyond the risk parameters set for the omnibus account.

•In CAST, ABC creates individual accounts and sets risk for those accounts.

•When any of those ABC individual accounts trade on Eurex, trades from ABC are submitted to XYZ and Eurex using the omnibus account. Because they all use the same route, they remain anonymous.

How Data is Transmitted