CQG offers a suite of Smart Orders that includes Iceberg, Brackets, DOM-Triggered Stops, Trailing, and OCO orders.

A bracket order is a multiple leg Order Places Order (OPO). The first leg is an order with any regular order type (main leg). Once that leg is filled or partially filled, either one or two additional orders are placed. Options are:

•The main order triggers both a target order (profit leg) and a stop order (loss leg).

•The main order triggers a target order.

•The main order triggers a stop loss order.

In the event that both a profit leg and a stop loss leg are placed, if one of those orders is filled, then the other order is cancelled.

For example, you place a buy bracket order for the E-Mini S&P 500 at 1450.00. You confirm that you want to make an 8-tick profit and suffer no more than a 5-tick loss. Once the buy order is filled or partially filled, a limit offer to sell at 1452.00 and a stop loss order at 1448.75 are placed. If one of those orders is filled, then the other order is automatically cancelled.

The main order cannot be an OCO, but bracket orders can be legs of an OCO. Bracket orders cannot be parked.

Bracket orders are active only when you are logged on to trade. When you log off, you receive a confirmation messages alerting you that you have active bracket orders and giving you a chance to cancel those orders. If you do not cancel the orders, then the main order is treated as a limit order and the profit and loss legs are cancelled.

Placing these orders requires an enablement from CQG and from you in Smart Order Preferences.

To enter a bracket order

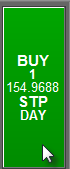

1. Click the Special Orders button drop-down arrow and select BRKT Bracket Mode, like this:

You’ll notice that order buttons and watermarks have brackets around them.

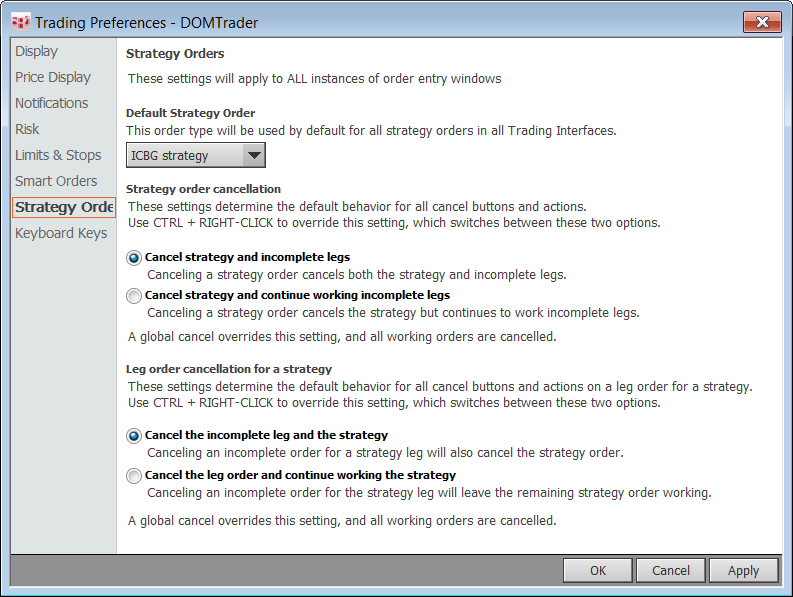

2. Place an order. A confirmation window opens.

In this example, once our buy order is filled, two stop orders are triggered, one at an 8-tick profit (target order) and one at a 5-tick loss (stop loss order).

On the confirmation window, you have the option of disabling one of the legs, so that a single order, either target or stop loss, is triggered when our buy order is filled.

3. To set up a target order, make sure the check box is selected. Choose tick, currency, or price for the profit measurement, enter a value, and select an order type.

4. To set up a stop loss order, make sure the check box is selected. Enter a tick value, and select the stop type.

5. Place the order.

To modify and cancel a bracket order

Modify and cancel bracket orders as you would for any orders on DOMTrader or Order Ticket.

If you modify the main order price or quantity, then the profit and loss orders are modified accordingly. Main legs that are rejected, cancelled, or expire result in the same action on the profit and loss legs.

If you cancel the target profit order, then the stop order is cancelled and vice versa.

Bracket orders are indicated on Orders and Positions with

this bracket icon:  .

.

The profit and loss legs of the order are displayed on the Parked tab until the main leg is filled or partially filled. If the main leg is partially filled, then the profit and loss legs are placed with the quantity of the partial fill. The open quantity becomes a new OPO with a new OCO (profit and loss) leg.

Once a working is filled or partially filled, then two orders are triggered on the other side of the market, one is stop order and one is a limit order.

The limit order indicates the profit you want to make and the stop order indicates the loss you are willing to take. Once on those orders is filled, the other is cancelled.

To exit bracket order mode

Select OCO in the linked orders menu.

To set speculation type

Speculation Type was introduced in response to MiFID regulations. It is displayed only if Speculation Type applies to the instrument or leg instrument (in the case of strategies) in use.

You can set the value at the order level or at the leg level.

Values entered for the legs are replicated in trading preferences and are used for the next bracket order.