CQG offers a suite of Smart Orders that includes trailing limit orders.

A trailing limit order tracks the market, automatically adjusting its price level position in the exchange’s order book.

For a buy order, as the best bid/offer/trade (depending on your settings) moves up, your order moves up with it based on the trailing offset. When the best bid/trade/offer trade moves down, your order holds. When the best bid/offer/trade matches your order price, the order executes.

For a sell order, as the best bid/offer/trade moves down, your order moves down with it.

For example:

You’re trading EP.

The trading preference is set to Current Bid on buys, Current Offer on sells.

The current bid = 2270.50.

You place a buy trailing limit = 2269.50, 4 ticks from bid, which is a trailing offset of 100.

(Offset is determined by where you place the order. Tick size = .25, so 4 ticks = 100 offset.)

If the market moves up a tick, your order moves up a tick. Your order always maintains the trailing offset as the bid moves up.

As the bid comes down, your order stays put.

When the bid comes down enough to match the price of the order, the order is executed.

Placing these orders requires an enablement from CQG and from you in Smart Order Preferences.

Modify size or cancel trailing limit orders as you would for any orders on the DOM. You cannot change the price of trailing orders.

To enter trailing limit orders

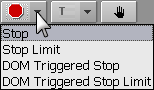

1. Click the Trailing Order drop-down arrow and select Trailing Limits, like this:

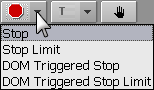

Notice the order type indicator and watermarks change:

2. Place your order.