Because some values (high, low, and close) are not known until after a market's close, you can set up a trade system that appears to be extremely successful, but won't work in reality. The following examples illustrate what can happen:

Example #1: In this example, the system is set up to enter on today's Open (the Order Type button) whenever today's close is greater than yesterday's close. However, you won't know the value of today's close until after the close occurs, so you can't truly base entry decisions on that future event.

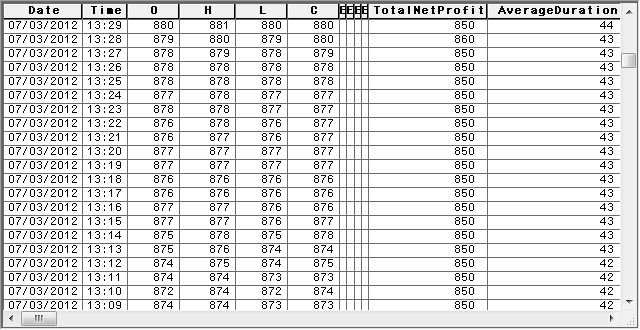

The graph shows the results of implementing this trade system. It reports a great profit profile. Unfortunately, it doesn't work like that in reality.

Example #2: This example illustrates a less obvious time-based mistake. Once again, the system is set to Enter on Open. This time the signal is based on an RSI.

While that might be fine, in this case, there is a problem because the RSI is based on the closing price.

Once again, you have extremely profitable results reported in the graph below, but that's because it reflects decisions that are based on future events, as a result of the RSI having a closing price parameter, while the trade system has an Open order type.

If you see remarkably profitable results reported by your trade system, check all your values to be sure your trade system isn't acting on information you won't have in real-time.