Before using Signal Evaluator, you should create the conditions and user values to use in the evaluation.

We are using:

•SigEval_Buy

•SigEval_Sell

We will apply these conditions both to individual commodities EP and CLE and to a small sample portfolio of symbols.

Signals

•Select the Buy at and Sell at signal conditions from the drop-down menus.

•Select the price/user condition from the drop-down menus.

•To create a new condition: click the button to open the Specify Long Entry Signal window, then click the Define Condition button.

•To create a new use value: click the button to open the Specify Long Entry Value window, then click Define User Value.

Commodity or Portfolio

•Select Commodity or Portfolio from the drop-down menu.

•For commodities: type the symbol. For portfolios: select a portfolio from the drop-down menu.

•To create a new portfolio, click the button to open the Select/Define Portfolio window, then click the New button.

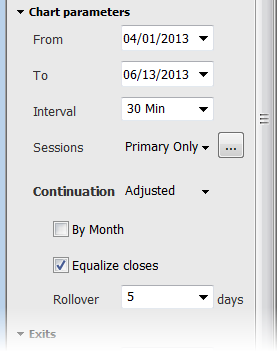

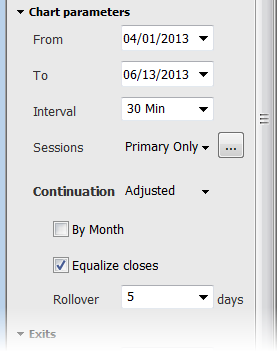

Chart parameters

|

Parameter |

Description |

|

From/To |

Either type dates or select them from the calendar drop-downs. The calendar also provides a link to go directly to today’s date. |

|

Interval |

Values: 1 Min, 5 Min, 10 Min, 15 Min, 30 Min, 60 Min Daily, Weekly, Monthly, Quarterly, Semi-Annual, Annual |

|

Sessions (intraday only) |

Values: All Sessions, Primary Session Only Click the button to create a custom session (only with commodity, not portfolio). |

|

Continuation type (not for portfolio)

|

Values: No continuation, Standard, Adjusted, Active Read more about continuation types, by month, equalize close, and rollover. |

|

By Month |

Limits display to month specified. |

|

Equalize closes |

Used only with Adjusted or Active. |

|

Rollover |

Used only with Adjusted. 1, 3, 5, 10 trading days before expiration |

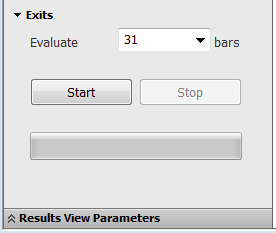

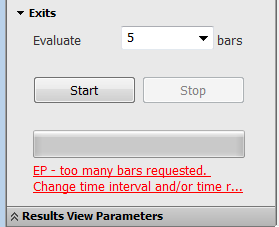

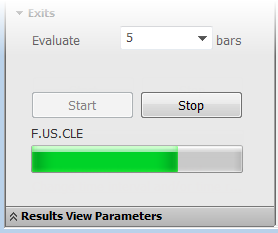

Exits

Type a value from 1 to 500, or select a pre-defined value from the drop-down menu.

Error Log Window

If there is any issue with the values you’ve selected or if there are other errors, an error statement is displayed on the bottom of the window. Click that link to open a log of all errors.