At expiry, the asset-or-nothing call option pays 0 if S <= X and S if S > X. Similarly, a put option pays 0 if S >=X and S if S < X.

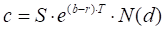

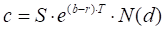

TheoV

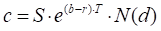

Call

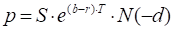

Put

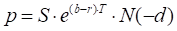

where

b – the cost-of-carry.

b = r to price options on stocks.

b = r – q to price options on stocks and stock indexes paying a continuous dividend yield q

b = 0 to price options on futures.

b = r – rf to price currency options (rf – risk-free rate of the foreign currency).

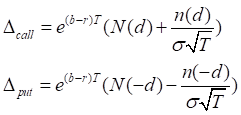

Delta

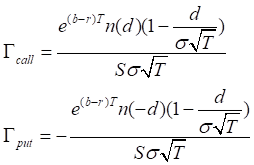

Gamma

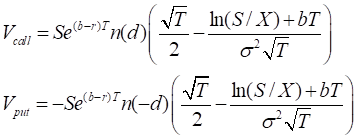

Vega

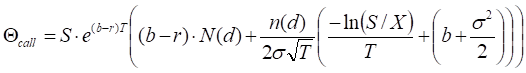

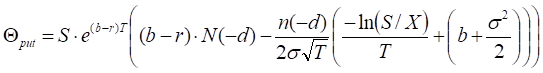

Theta

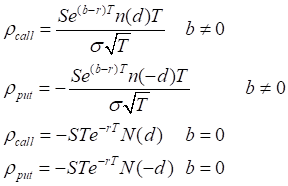

Rho

Implied volatility

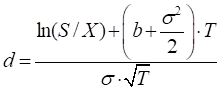

To find implied volatility the following equations should be solved for the value of sigma:

Call

Put

System numerically solves these equations.