Theoretical value of a call

Theoretical value of a callIn 1976, Fisher Black developed a modification to the Black-Scholes model designed to price options on futures more precisely. The model assumes that futures can be treated the same way as securities, providing a continuous dividend yield equal to the risk-free interest rate.

The model provides a good correction to the original model concerning options on futures. However, it still carries the restrictions of the Black-Scholes evaluation.

Notation

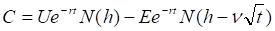

Theoretical value of a call

Theoretical value of a call

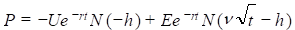

Theoretical value of a put

Theoretical value of a put

Underlying

price

Underlying

price

Strike

price

Strike

price

Interest rate

Interest rate

Time

to expiration in years

Time

to expiration in years

Volatility

Volatility

Cumulative normal density function

Cumulative normal density function

The theoretical values for calls and puts are:

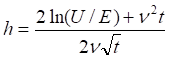

Where:

Note: Although similar, this definition of  is different from the one used in the

Black-Scholes model.

is different from the one used in the

Black-Scholes model.

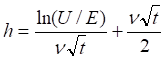

An alternative form for  is:

is: