The generalized Black-Scholes model can be used to price European options on stocks without dividends [Black and Scholes (1973) model], stocks paying a continuous dividend yield [Merton (1973) model], options on futures [Black (1976) model], and currency options [Garman and Kohlhagen (1983) model].

TheoV

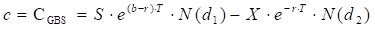

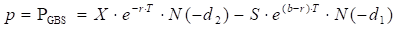

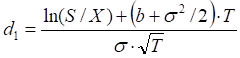

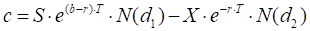

Call

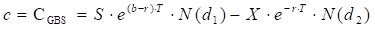

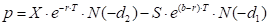

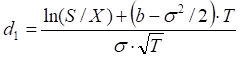

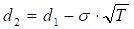

Put

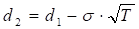

where

N(x) – the cumulative normal distribution function;

S – underlying price;

X – strike price of option;

r – risk-free interest rate;

T – time to expiration in years;

σ – volatility of the relative price change of the underlying stock price.

b – the cost-of-carry rate of holding the underlying security.

b = r gives the Black and Scholes (1973) stock option model.

b = r – q gives the Merton (1973) stock option model with continuous dividend yield q.

b = 0 gives the Black (1976) futures option model.

b = r – rf gives the Garman and Kohlhangen (1983) currency option model (rf - risk-free rate of the foreign currency).

Delta

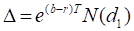

Call

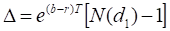

Put

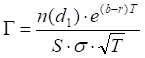

Gamma

Gamma is identical for put and call options.

where

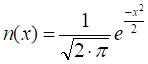

- normal

distribution function.

- normal

distribution function.

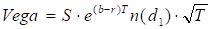

Vega

Vega is identical for put and call options.

Theta

Call

Put

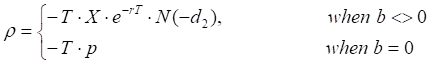

Rho

Call

where

c – call TheoV

Put

where

p – put TheoV

Implied volatility

To find implied volatility the following equations should be solved for the value of sigma:

Call

Put

where

This equation has no closed form solution, which means the equation must be numerically solved to find σ.