CVB bars are built based on volume - tick or exchange volume when available. Time is not a factor.

Each bar in a Constant Volume Bar chart contains a specified volume level. This volume level is reached by accumulating the volume of each of the underlying bars. When the volume level is reached, the next Constant Volume Bar begins to accumulate volume from the underlying bars.

When you have a custom BATS filter on the chart to process best bid/ask quotes, each quote affects the volume output in these ways:

•Total tick volume is increased.

•Bid/Ask tick volume, filtered tick volume, filtered bid/ask tick volume are not increased.

•Trader volume, filtered trade volume, bid/ask trade volume, and filtered bid/ask trade volume are not increased.

You can apply large trade detection to volume using the Aggressive parameter.

Suppose these limit orders are working at a single price:

10 lots, 1 lot, 2 lots, 1 lot, 10 lots, 100 lots

An order is placed for 1 lot and fills against the first working order, making the quantities:

9 (partially filled), 1, 2, 1, 10, 100

Next, an order is placed for 3 lots, so the order sizes become:

6, 1, 2 ,1, 10, 100

Then, an order is placed for 100 lots, so the order sizes become:

0 (filled), 0, 0, 0, 0, 20

So, the fill amounts were:

1, 3, 6, 1, 2, 1, 10, 80

Constant volume bars indicate the number of lots (104) or the number of ticks (8) depending on the value selected in the Type parameter.

Missing from this information is any indication that an order for 100 lots was triggered.

Both lots and ticks provide information about the passive side of trading. With the aggressive parameter turned on, the number of orders (3) is exposed, revealing the role of aggressors in the current market.

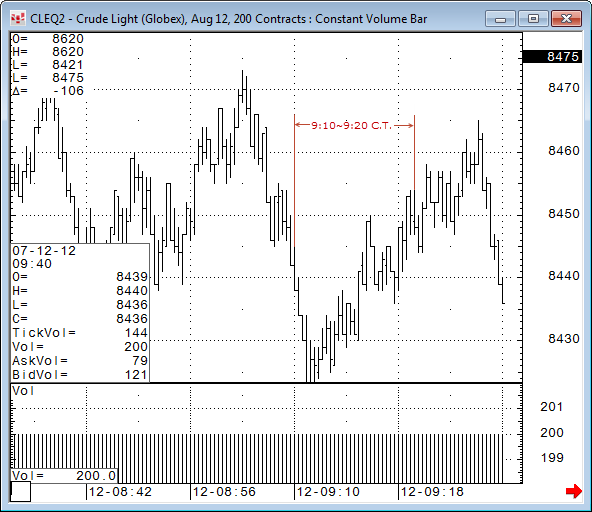

One application of these charts is to expose more information about high spike in volume. In this image, we notice a spike in volume at 9:10-9:20 CT, but the specific candlestick does not provide much information before the closing price.

A constant volume chart may be helpful in this scenario. In this image, a constant volume of 200 is used to better understand the trend hidden in the time-based candlestick chart.

CVB analysis is not the same as Equal Volume Bar analysis.

Constant Volume Bar analysis is not available for spreads or for contracts being received on a delayed basis.

Constant Volume Bar Parameters

|

Parameter |

Description |

|

Display |

Opens sub-window with Color, MarkIt, and Display parameters. Color = Select colors for CVB bars. Highlight Up/Down Highlight 2-bar Overlap: If checked, then the portion of the previous bar’s range that overlaps the current bar’s range will be colored. Highlight 3-bar Overlap: If checked, then the portions of both of the two previous bar’s price range that overlaps the current bar’s range will be colored. Note that the smallest range of either bar is used for the range MarkIt = Opens the Specify Conditions for Marking Bar window. Display = Choose line type: bar, line, or candle. |

|

Volume Level |

Select volume covered by each bar. |

|

Type |

Volume type. Values: •Tick Only = number of inside price changes, i.e. the count of how many times a last price has been changed over a time period. •Exchange or Tick = exchange volume is used if it’s available, otherwise ticks are used. |

|

Flat Ticks |

Select this check box to use 0-plus and 0-minus ticks when building bars. |

|

Aggressive |

Select this checkbox to apply large trade detection to quotes. Consecutive trades are considered one large trade if all of the following conditions are met: •They all happened on the same side. •There were no intervening opposite side trades among them (trade that is split between bid and ask is not considered intervening). •They happened within 50 milliseconds of each other (TFlow only). •No BBA updates occurred between trades. If consequent trades are combined into one large trade, they are considered one tick. If trades inside one large trade were executed at different prices, then all prices are used to construct the new OHLC of the CVB bar. Applies only to tick volume. Must be used with flat ticks. Requires enablement. |