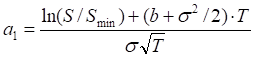

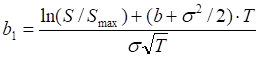

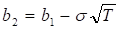

where

The Lookback models are used to price European lookback options on stocks without dividends, stocks and stock indexes paying a continuous dividend yield and currency options.

A floating strike lookback call gives the holder of the option the right to buy the underlying security at the lowest price observed, Smin, in the life of the option. Similarly, a floating strike lookback put gives the option holder the right to sell the underlying security at the highest price observed, Smax, in the option’s lifetime.

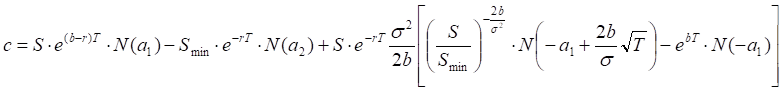

TheoV

Call

where

b – the cost-of-carry;

b = r to price options on stocks;

b = r – q to price options on stocks and stock indexes paying a continuous dividend yield q;

b = r – rf to price currency options (rf – risk-free rate of the foreign currency);

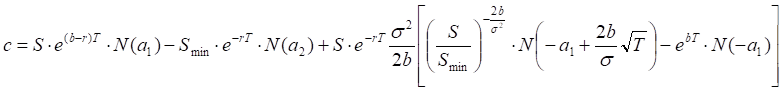

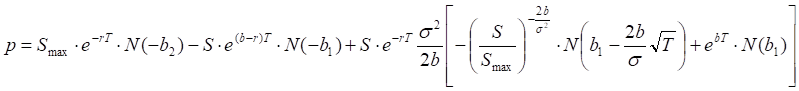

Put

where

where

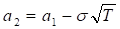

.

.

Delta, Gamma, Vega, Theta, Rho

The system uses the numerical differentiation to calculate the Greeks.

Implied volatility

The system uses numerically find implied volatility.