The Ho-Lee model (1986), an interest rate model is the no-arbitrage model. The model allows closed-form solutions for European options on zero-coupon bonds.

TheoV

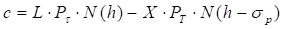

Call

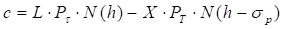

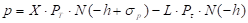

Put

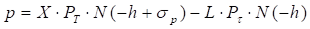

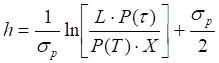

Where

L – bond principal (i.e. face value),

τ – bond time maturity,

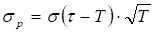

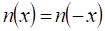

,

,

,

,

P(T) - the price at time zero of a zero-coupon bond that pays $1 at time T,

The distinctions from Vasicek model are

- PT and Pτ are input parameters,

- σp expression is different.

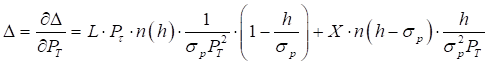

Delta

Call

Put

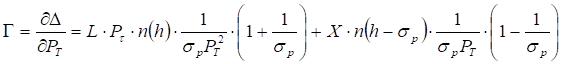

Gamma

Gamma is identical for put and call options.

Vega

Because

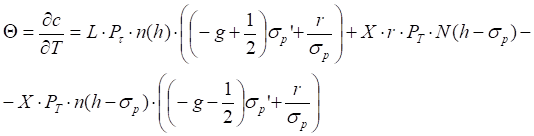

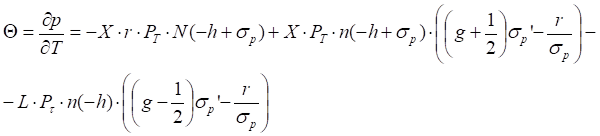

Theta

Call

Put

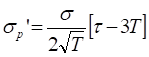

where

,

,

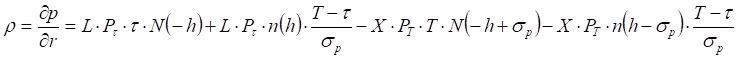

Rho

Since the price at time zero of a zero-coupon bond that pays $1 at time t is

then

then

Call

Put

Implied volatility

The system finds implied volatility numerically.