This study calculates the Market Profile’s value area and point of control (POC).

The value area begins calculating at the POC. The system expands the value area one price at a time in either direction until the value area represents 70% of the TPOs, choosing the direction on each iteration on the basis of the number of TPOs the two prices adjacent to the current value area have. It is expanded in the direction of the price having more TPOs.

The high boundary of the value area is represented by a green line, and the low boundary of the value area is represented by a red line. You can change these colors.

The POC is calculated as the price that has the maximum TPO during the specified time period. If several prices have the same max TPO, then the price that is closest to the middle price range is the POC price. The POC is blue by default.

Traders may want to analyze the value area’s width to determine trade facilitation. Traders may also want to compare the previous day’s value area to the current day. A higher value area may indicate that the market is buying. TPO value areas are available on all contracts.

POCHi and POCLo can be incorporated into your custom formulas to identify a range of POCs. The MPVA study available in the Formula Toolbox has been updated with these new range values.

Contact CQG if you would like to be enabled for this study.

Details of MPVA Calculation

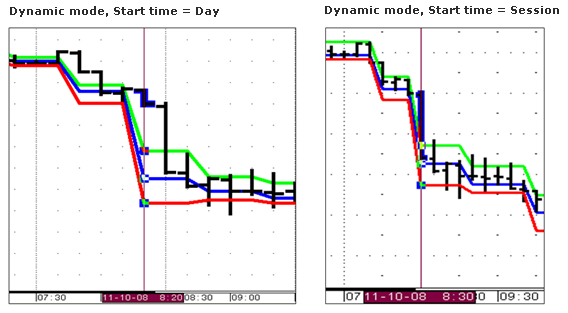

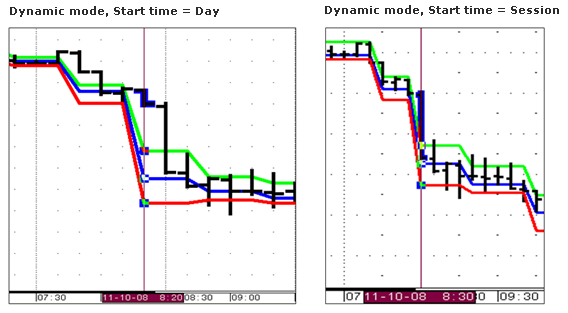

MPVA in dynamic mode: Dynamic mode allows you to calculate and show MPVA values for a custom-defined time interval on an intraday chart. In this case, any time the interval range is calculated from session start time or day, start time and MPVA study values for every time interval will take into account TPO of prices from the day or session start time, so dynamic mode shows how MPVA values are changing within the day or session for every defined time interval.

MPVA for intraday charts: This study is calculated on base of 5 min (or 1 min) bars. Using 5 min bars is the default. If the dynamic interval in dynamic mode isn't divisible by 5, then 1 min bars are used in the calculation. For every bar, MPVA values correspond to the end of this bar rather than its start time. This helps reflect the market state for the end of bar. It is especially helpful with Point and Figure, TFlow, and Constant Volume Bar charts where bar times aren’t determined.

For example, if Dynamic Interval = 30, and there is one 1.5 hour bar (including approximately 3 time intervals), MPVA values will be calculated based on bars from day or session start time until the last dynamic interval that starts inside this long bar.

Example:

Session start = 8:30 a.m.

Dynamic Interval = 30 min

Dynamic mode is On

PF start bar time = 9:45 a.m.

end bar time = 10:50 a.m.

So, for this Point and Figure bar, the dynamic interval is 10:30 – 11:00 and will include data for the 8:30 – 11:00 period.

MPVA for historical charts: The start time parameter in dynamic mode are ignored for historical charts. Instead, for daily charts, the month interval is used for MPVA calculation; for weekly, every 3 months (starting from January); for monthly, yearly; for quarterly, every 4 years (since 1900); for semiannual, every 10 years (since 1900); for yearly, every 20 years (since 1900). Real bars (rather than 5 or 1 min bars) are used for the MPVA calculation.

Chart continuation settings apply to the volume output. Because equalized closes are not compatible with volume profiles, if that option is selected in chart preferences, then volume profiles are displayed for the current contract only.

Market Profile Value Areas Parameters

|

Parameter |

Description |

|

MPInterval |

Chart interval by which the MPVA study is calculated. Select a value from the drop-down menu or enter a valid value. Chart continuations settings are used during MPVA calculation only if MPInterval is selected from the options provided. If MPInterval is being used with a historical chart: (a) Intraday values indicate the time intervals used to calculate study values. For example, 30 minutes indicates that the MPVA is build using 30-minute Time Price Opportunities (TPO). (b) Historical values indicate these values are used for MPVA calculation: •Daily = daily TPO are used for calculations; MPVA values are calculated for each month •Weekly = weekly TPO are used for calculations; MPVA values are calculated for each quarter •Monthly = monthly TPO are used for calculations; MPVA values are calculated for each year •Quarterly = quarterly TPO are used for calculations; MPVA values are calculated for every 4 years (from 1900) •Semi-Annual = semiannual TPO are used for calculations; MPVA values are calculated for every 10 years (from 1900) •Annual = yearly TPO are used for calculations; MPVA values are calculated for every 20 years (from 1900) If chart interval is greater than MPInterval, MPVA values are calculated for each chart bar. |

|

StartTime |

Opens sub-window to calculation start time. Values: •StartTime = Day, Session, Date/Time, Condition, Bars Back, or Days Back. Used with other parameters on this window. •Date = Active when StartTime = Date/Time. •Time = Active when StartTime = Date/Time. •Condition = Active when StartTime = Condition. •Lookback = Active when StartTime = Condition. •Bars Back = Active when StartTime = Bars Back. •Days Back = Active when StartTime = Days Back. |

|

Dynamic |

If selected, dynamic mode is turned on. And, if selected, Volume mode is not available. If not selected, static mode is turned on. Ignored if MPInterval or chart interval is historical. |

|

DynamicInterval |

Active when Dynamic is selected and only for intraday MP Interval/charts. Timeframe for the dynamic session for the volume type. If the time interval is not divisible by the chart time, then the time interval is rounded to the nearest divisible value. |

|

Calculate On |

Values: •Price •Volume |

|

Type |

Volume type. Values: •Exchange Only = total number of contracts traded during the selected chart interval. •Tick Only = number of inside price changes, i.e. the count of how many times a last price has been changed over a time period. •Exchange or Tick = exchange volume is used if it’s available, otherwise ticks are used. |

|

Display |

Opens sub-window to set parameters: •Color = Line color. •Weight = Line thickness. •Display = Line style: none, dash, or line. •Labels = Choose none, price, amount, or both. •% Dist = Range of the value area: n% of the volume occurs within this range. •POC Distance = Number of ticks between POCs. For example, a setting of 5 indicates that a range of 5 ticks is ignored when searching for the next POC. for MPVA components, including: •TPO Profile = number of time segments that this price traded at. |