Theoretical value of a call

Theoretical value of a callIn 1973, Merton produced a model with a non-constant interest rate. He assumed that interest rates follow a special type of random process.

By taking into consideration the dynamic process of interest rate determination, and the correlation between the underlying price and the options price, this model provides an improvement over the Black-Scholes model. This model is generally used to value European options written on stocks.

Notation

Theoretical value of a call

Theoretical value of a call

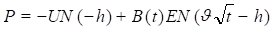

Theoretical value of a put

Theoretical value of a put

Underlying price

Underlying price

Strike price

Strike price

Time to expiration in years

Time to expiration in years

Cumulative normal density

function

Cumulative normal density

function

Volatility

Volatility

Volatility of an interest rate contract

Volatility of an interest rate contract

Interest rate

Interest rate

Correlation between the underlying and interest rate contracts

Correlation between the underlying and interest rate contracts

The theoretical values for European calls and puts are:

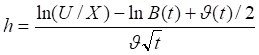

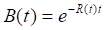

Where: