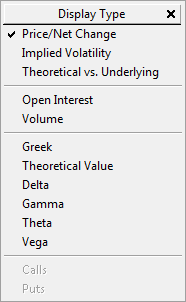

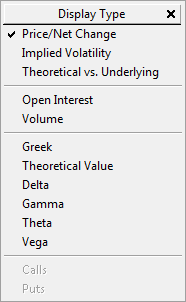

The Options Window, a tabbed window, has three views: Standard, Greek, and Theoretical versus Underlying.

The Standard view changes based on the value you want displayed: LPrice, TheoV, Delta, Gamma, Theta, Vega, IV, Open Int, and Volume.

The title bar indicates which view is active.

To open the Options window, click the OptWnd button on the toolbar. If the button is not displayed, then click the More button, and then click Options. You can also click the Options button and then click Options Window.

Standard view

Data in the top row includes:

UndPr = underlying price

DTE = number of calendar days until expiration

EXP = expiration date

VOL = default volatility used for calculations, default values is set in Options preferences:

IVS = implied volatility shift, sets the increase or decrease of all implied volatility values

IR = default interest rate calculated by taking 1 – near term T-Bill price

Data in the bottom row includes the strike price, the bid or ask price, and then a value based on your settings. For example, if the LPrice button is selected, then this value is last price net change. If the Theta button is selected, last price and theta is displayed.

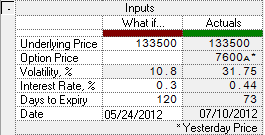

In this example:

•pink text = yesterday extended colors

•red text = daily net down

•green text = daily net up

Colors can be changed.

Greek view

The Greek view displays data for one month’s call or put.

Data in the top row includes:

UndPr = underlying price

DTE = number of calendar days until expiration

Exp = expiration date

Vol = default volatility used for calculations

IVS = implied volatility shift, sets the increase or decrease of all implied volatility values

IR = default interest rate calculated by taking 1 – near term T-Bill price

You can choose the columns to be displayed.

Move to another month by clicking the <<>> button. Move between calls and puts by clicking the Calls button and the Puts button.

Note: CQG uses coherent ('at the time") price evaluation to calculate Greek values. In other words, the system uses the underlying value at the time the option traded to calculate Greek values.

Theoretical versus underlying (T/U) view

The T/U view displays data according to strike price.

Data in the top row includes:

UndPr = underlying price

DTE = number of calendar days until expiration

Exp = expiration date

Vol = default volatility used for calculations

IVS = implied volatility shift, sets the increase or decrease of all implied volatility values

IR = default interest rate calculated by taking 1 – near term T-Bill price