Welles Wilder's Parabolic SAR study is a time/price reversal system. The letters "SAR" stand for "stop and reverse" meaning that the position is reversed when the protective stop is hit.

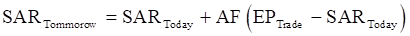

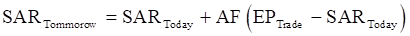

It is a trend-following system. As prices trend higher, the SARs tend to start out slower and then accelerate with the trend. In a downtrend, the same thing happens but in the opposite direction. The SAR numbers are calculated and available to the user for the following day based on the following equation:

where: AF begins at 0.020 (default value) and is increased by .02 each bar that a new high/low is made (depending on the trend direction) until a value of 0.20 is reached; EP = Extreme Price point for the trade made so far (if Long, EP is the extreme high price for the trade; if Short, EP is the extreme low price for the trade).

Thus, the Parabolic Time/Price System rides the trend until the SAR price is penetrated. Then the existing position is closed out and the reverse position is opened.

Parabolic Outputs

•Para: Value of the active parabolic curve (either ParaUp or ParaDn).

•ParaUp: Value of the ParaUp curve.

•ParaDn: Value of the ParaDn curve.

•ParaStep: How much the step factor increases for each new high or low. Based on the highest previous high or the lowest previous low and the ParaStep value.

•ParaDir: If the parabolic curve is going up, then ParaDir = 1. If the parabolic curve is going down, then the ParaDir = -1.

Parabolic Parameters

|

Parameter |

Description |

|

Display |

Opens sub-window to set parameters •Color = Line color. •Weight = Line thickness. •MarkIt = Opens Specify Conditions window. •Display = Line style: dash or histogram. •ShareScale = Determines whether sharing of the vertical scales between studies is accepted. Auto = System determine whether sharing is feasible. On = Scale is shared regardless of the functions and studies displayed. Off = Scale is not shared. ShareScale must be On if study is overlaid on a study with multiple outputs. |

|

StepFactor |

Percentage of the previous move used to calculate the new position. |

|

StartValue |

Start of multiplier factor. |

|

MaxValue |

Maximum multiplier factor. |

|

At Tick |

When selected, the value is plotted at the nearest tradable price away from the market. In other words, when the volatility stop price is below the bar price, it becomes the floor price, and when the volatility stop price is above the market, it becomes the ceiling price. When off, the volatility stop value is shown at its exact price. |

|

Digits |

Number of digits after the decimal point in the study’s outputs. |

|

Mode |

Values: •CQG = delays Parabolic Step ratcheting by 1 bar •Original = ratcheting begins immediately, as established by Welles Wilder |