The advanced strategy feature allows you to set up various WhatIf scenarios using 5 variables, Volatility, Interest Rate, Days till Expiration, and Spread.

Additionally, you can plot up to 8 curves using different values of the 5 variables.

To open this window, click the Advanced button.

To select the range manually

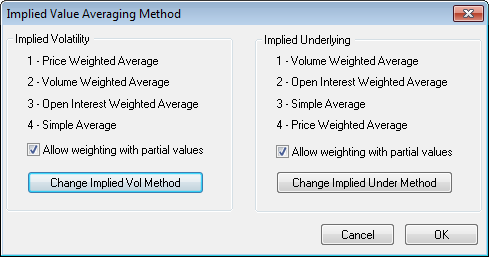

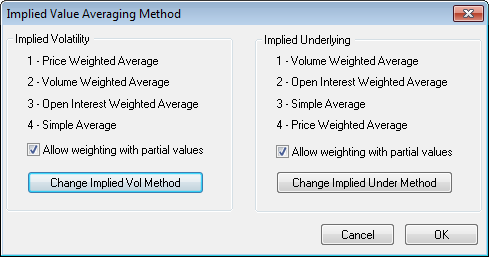

1. Click the Support Ranges checkbox.

1. Select the From or To box which corresponds to the variable whose range you are creating.

2. Input the desired from and to range values.

To select the range automatically

The range of values used when users choose the Select Range checkbox depends on the period selected. However, the method of calculating the range is the same. The system calculates the range using the high and low values for the selected period, and distributes the curves evenly within the range.

This procedure assumes that all three ranges are being set up for automation.

1. Click the Support Ranges checkbox.

2. Click the Auto Select Ranges button to open the Auto Select Ranges window.

3. On the Volatility tab, select the Select volatility range check box.

4. Choose a method from the drop-down menu, and click the Setup button to make changes to the method.

5. Choose the contract.

6. Select Period or Take last and enter the desired value.

7. Click the Interest Rate tab.

8. Select the Select interest rate range check box.

9. Select a method from the drop-down menu.

10. Choose the contract.

11. Select Period or Take last and enter the desired value.

12. Click the Spread tab.

13. Select the Select spread range check box.

14. Choose the contract.

15. Select Period or Take last and enter the desired value.

16. Click OK.