Options applications share many of the same preferences.

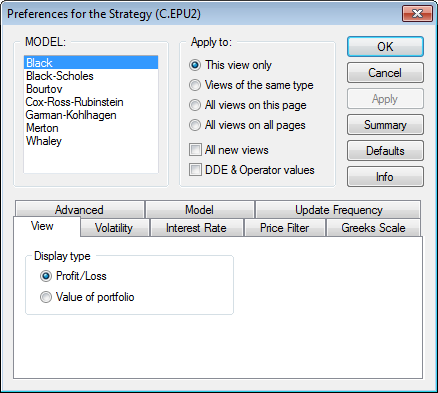

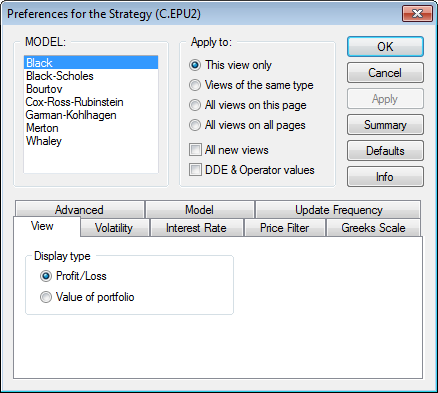

To set options preferences, click the Setup button and then click Options Preferences (or preferences for the active window). You can also click the Prefs button on the Options toolbar.

To start, select the model and where to apply these preferences. If you select RTD & Operator values, changes apply to other areas where options are used, such as custom studies.

•Click the Summary button to view, print, and save (.dat file) the current settings.

•Click the Defaults button to return to default values.

Other Options preferences include (tabbed area at bottom of window):

•View settings allow you to show or hide Greek and implied volatility scales, order columns, and set extended coloring parameters.

•Volatility settings allow you to set the implied volatility type, evaluation method for average volatility, and select a volatility calculation type.

•Interest Rate settings allow you to set the interest rate for various currencies.

•Price Filter settings allow you to select which price to use for underlying and option. You can also choose to use most recent settlement prices.

•Greeks Scale settings allow you to set the price scale, time direction, and time scale and to choose percent or fractions for implied volatility and delta and gamma.

•Advanced settings allow you to select the underlying contract type and increase days to expiration.

•Model settings allow you to define parameters for each model.

•Update Frequency settings allow you to set the refresh period for average volatility, interest rate, and new/removed contract and to set update delays for theoretical value and the Greeks.