|

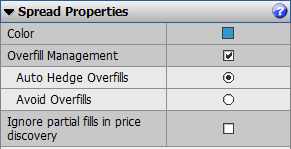

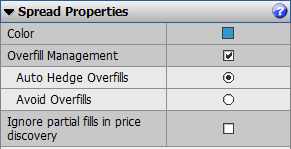

Parameter |

Description |

|

Color

|

Click the color button to open a standard color selector. (You can also right-click the color-coded area on DOMTrader or Order Ticket, and then click Set color.) |

|

Overfill management

|

It is possible to get overfilled when legs are being worked aggressively. Suppose you are working a 5-lot spread of 1:2, looking to be filled at 5:10. In actuality, you are filled at 7:10. This parameter specifies how to manage this overfill. No selection: Indicates that the trader manages the overfill and that the system should take no action. Auto Hedge Overfills: Indicates that when either the working or leaning leg is overfilled, the system should try to maintain the leg ratio. In this example, the result is an order for four lots on the second leg. Avoid Overfills: Indicates that the system should minimize the chance for an overfill to occur by working legs less aggressively. Specifically, the system waits for the exchange to acknowledge its previous action before it adds quantity or places another order. Suitable only when working one leg of a spread. In the case where you are overfilled one lot on the second leg, 5:11 for example, the system cannot hedge the spread because maintaining the ratio would require a half-lot order on the first leg. |

|

Ignore partial fills |

It’s best to explain this parameter through an example: Suppose SPREAD(A-B,,,10:1) is being traded with A set as the working leg, Buy 1@10. After strategy order placement, the system works a primary order on A 10@100. Market B shows a best bid of 90. The order is partially filled 3@100 on A. Market B then changes to 95, so the primary order is modified to 7@105. At this price, a second partial fill 6@105 occurs. Market B returns to 90, and the last lot on A is filled with price 100. In total, we have 3 partial fills for the first leg: 3@100, 6@105 and 1@100. Now the secondary order price needs to be chosen. If Ignore partial fills is not checked, we calculate a secondary order price that would lead to a strategy order fill at the desired strategy price. First, the average fill price for the primary orders have to be calculated. Then, the secondary order price is calculated to satisfy the strategy price. This way of handling partial fills does help with strategy price execution, but sometimes leads to undesirable results. From our example: primary order average price = (3*100 + 6*105+1*100)/10 = 1030/10 = 103, thus secondary order price = A - S = 103-10 = 93, and a secondary order Sell 1@93 is placed. If market B shows a best bid of 1@90, that secondary order will likely hang. If Ignore partial fills is checked, it tells the system to ignore fill prices on the primary orders. Instead, the secondary order is placed to hit the opposite market side. In this case, strategy price execution cannot be guaranteed, but hang probability is decreased. From our example: if market B shows a best bid of 1@91, a secondary order Sell 1 @ 91 is placed. |