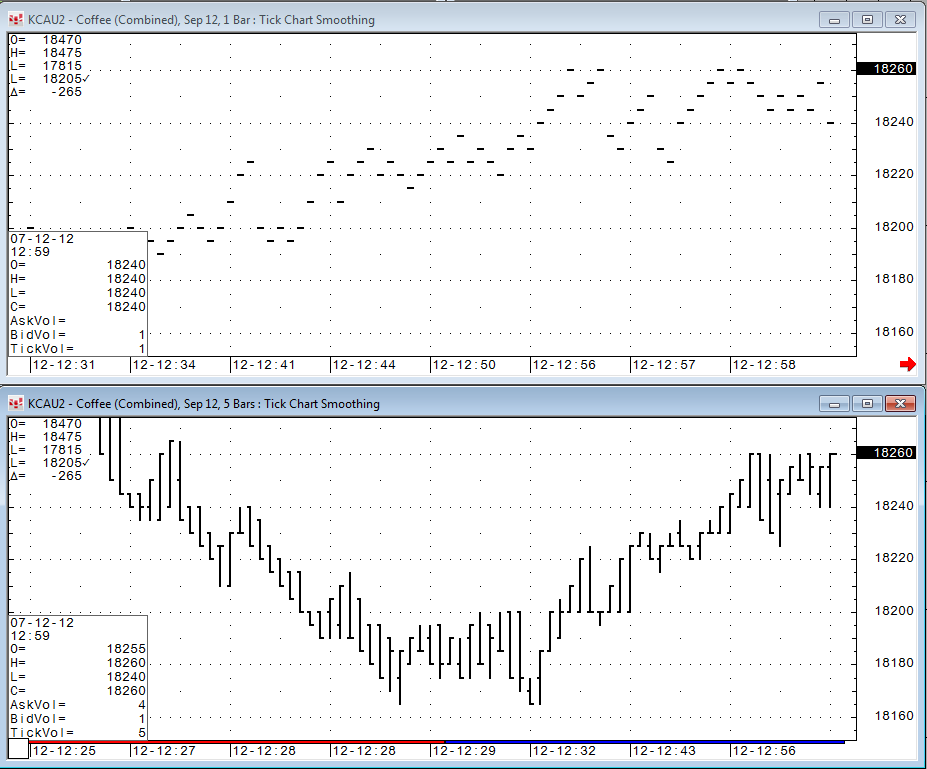

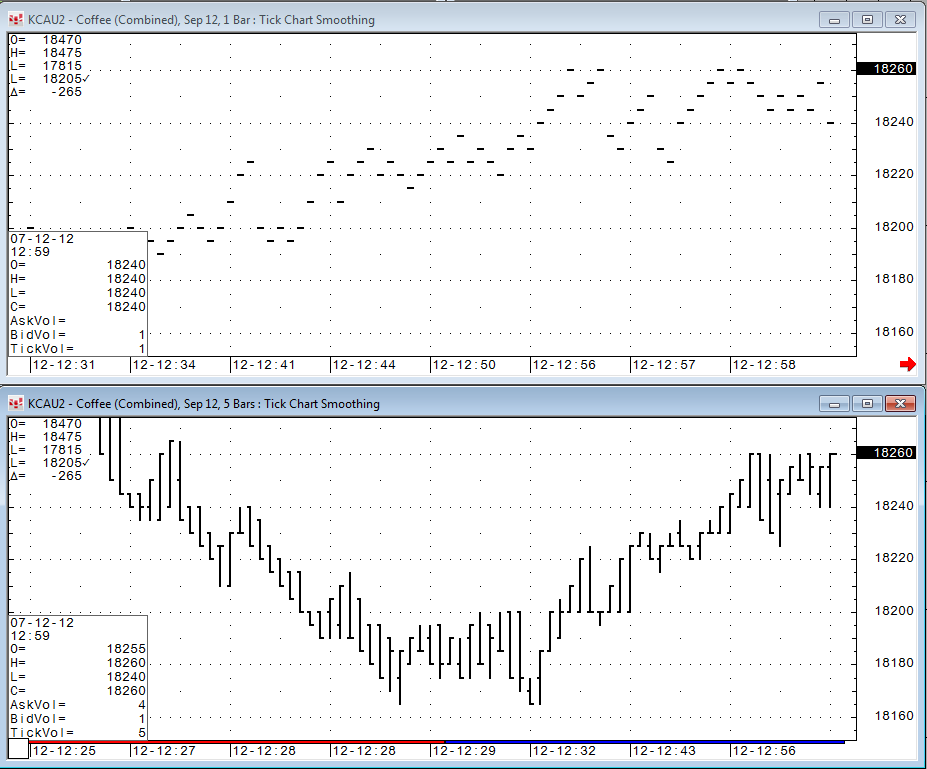

This study displays ticks aggregated with a smoothing algorithm. It is based on trade ticks only.

Smooth tick chart bars are built as follows:

•First ticks do not produce bars until the session has only first ticks. The first smoothed bar starts building immediately as the session starts.

•All ticks following the first tick produce a bar. The high and low are calculated as maximum and minimum prices among last n ticks, as set in the parameters.

•If the bar's high and low match or lie within the previous bar, the bar is added to previous bar.

The time of the smoothed tick chart bar is set by the start tick. The smoothing algorithm will restart on session boundaries.

You can apply large trade detection to volume using the Aggressive parameter.

Suppose these limit orders are working at a single price:

10 lots, 1 lot, 2 lots, 1 lot, 10 lots, 100 lots

An order is placed for 1 lot and fills against the first working order, making the quantities:

9 (partially filled), 1, 2, 1, 10, 100

Next, an order is placed for 3 lots, so the order sizes become:

6, 1, 2 ,1, 10, 100

Then, an order is placed for 100 lots, so the order sizes become:

0 (filled), 0, 0, 0, 0, 20

So, the fill amounts were:

1, 3, 6, 1, 2, 1, 10, 80

Tick bars indicate the number of ticks (8).

Missing from this information is any indication that an order for 100 lots was triggered.

Ticks provide information about the passive side of trading. With the aggressive parameter turned on, the number of orders (3) is exposed, revealing the role of aggressors in the current market.

•Open (start tick of the bar)

•High (highest tick)

•Low (lowest tick)

•Close (price of last trade added to the bar)

•Volume (sum of volumes of included trades)

•TickVol (amount of included ticks)

Tick Chart Smoothing Parameters

|

Parameter |

Description |

|

Color |

Select color of bar. |

|

MarkIt |

Opens the Specify Conditions for Marking Bar window. |

|

Aggregation Level |

Tells the system to create a new bar for every n bars or when the range exceeds n ticks. |

|

Flat Ticks |

Select this check box to use 0-plus and 0-minus ticks when building bars. |

|

Aggressive |

Select this checkbox to apply large trade detection to quotes. Consecutive trades are considered one large trade if all of the following conditions are met: •They all happened on the same side. •There were no intervening opposite side trades among them (trade that is split between bid and ask is not considered intervening). •They happened within 50 milliseconds of each other (TFlow only). •No BBA updates occurred between trades. If consequent trades are combined into one large trade, they are considered one tick. If trades inside one large trade were executed at different prices, then all prices are used to construct the new OHLC of the CVB bar. Applies only to tick volume. Must be used with flat ticks. Requires enablement. |