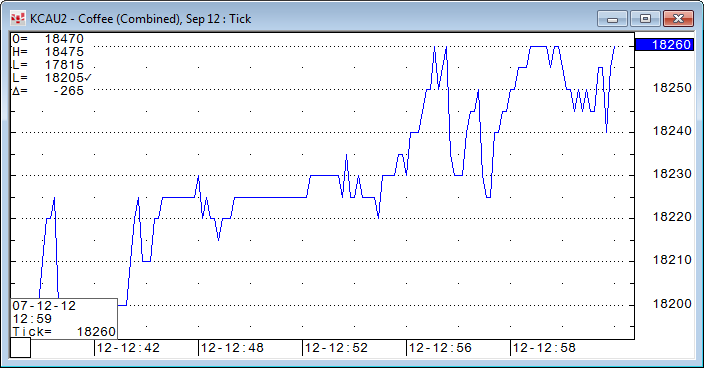

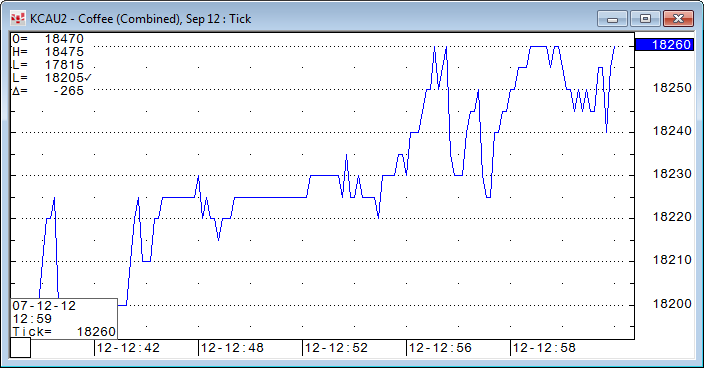

Tick charts display each price traded as a unique point on the chart.

A reported trade that immediately follows an identical trade is considered a flat tick. the second trade, the flat tick, is shown on the tick chart only when the flat tick checkbox is selected.

If bids and asks are not normally used to build bar charts for a particular market, the bids and asks are not shown on tick charts.

When you have a custom BATS filter on the chart to process best bid/ask quotes, each quote affects the volume output in these ways:

•Bid/Ask tick volume, filtered tick volume, filtered bid/ask tick volume are not increased.

•Trader volume, filtered trade volume, bid/ask trade volume, and filtered bid/ask trade volume are not increased.

You can apply large trade detection to volume using the Aggressive parameter.

Suppose these limit orders are working at a single price:

10 lots, 1 lot, 2 lots, 1 lot, 10 lots, 100 lots

An order is placed for 1 lot and fills against the first working order, making the quantities:

9 (partially filled), 1, 2, 1, 10, 100

Next, an order is placed for 3 lots, so the order sizes become:

6, 1, 2 ,1, 10, 100

Then, an order is placed for 100 lots, so the order sizes become:

0 (filled), 0, 0, 0, 0, 20

So, the fill amounts were:

1, 3, 6, 1, 2, 1, 10, 80

Tick bars indicate the number of ticks (8).

Missing from this information is any indication that an order for 100 lots was triggered.

Ticks provide information about the passive side of trading. With the aggressive parameter turned on, the number of orders (3) is exposed, revealing the role of aggressors in the current market.

Tick charts are not available for contracts quoted on a delayed basis.

Tick charts can work well with products that aren’t as active.

Tick Parameters

|

Parameter |

Description |

|

Color |

Select color of bar. |

|

Weight |

Select thickness of bar. |

|

MarkIt |

Opens the Specify Conditions for Marking Bar window. |

|

Flat Ticks |

Select this check box to use 0-plus and 0-minus ticks when building bars. |

|

Aggressive |

Select this checkbox to apply large trade detection to quotes. Consecutive trades are considered one large trade if all of the following conditions are met: •They all happened on the same side. •There were no intervening opposite side trades among them (trade that is split between bid and ask is not considered intervening). •They happened within 50 milliseconds of each other (TFlow only). •No BBA updates occurred between trades. If consequent trades are combined into one large trade, they are considered one tick. If trades inside one large trade were executed at different prices, then all prices are used to construct the new OHLC of the CVB bar. Applies only to tick volume. Must be used with flat ticks. Requires enablement. |