DOMTrader and Order Ticket have options-specific components. The current strike price is displayed, and you can change the model and Greeks directly on the trading application. The Account Summary area of Orders and Positions also has options-specific data.

There are trading preferences that are specific to options trading. As an options trader, you may want to:

•Add a Greek column to DOMTrader (Trading Preferences > Display > Greek column for options)

•Highlight theoretical value on the DOMTrader (Trading Preferences > Display > Price column)

•Select on options model (Trading Preferences > Trading Display > Options)

•Use theoretical value to calculate UPL/MVO (Trading Preferences > Trading Display > Status)

See also: User-Defined Strategies (UDS)

Greek and IV Calculation on Trading Applications

The values displayed in the Greek column on DOMTrader and Order Ticket are analogs of the values displayed in the Options Calculator in the “what if” mode.

On the DOMTrader, we have a ladder of option prices; which (except for those where the market is) are just potential prices at which the option may be traded. To calculate a Greek/IV value for any particular potential option price from the grid (let us take some value and denote it OP1) we must predict which underlying price and IV at the moment will be when/if the option price is equal to OP1. To this purpose, the volatility curve is used. (This is why using volatility curve is the only available choice in the options preferences for DOMTrader).

Namely, for each underlying price UPx from a discrete mesh in a certain range around the current underlying price, we calculate the corresponding value of IV by horizontally shifting the volatility curve from the strike price by the difference between this UPx and the real current underlying price:

IV (UPx) = VolCurve(StrikePrice + (ActualUP – UPx)).

Then, for each UP value from this mesh and such calculated corresponding value of IV, we calculate corresponding value of option price (OP). As a result, we obtain kind of a curve OP(UP). Then, for each value of OP1 on the DOMTrader grid, we seek the corresponding UP1 value on this curve, and for this UP1 value and corresponding IV(UP1) found we calculate, as described above, the Greek value depending on what is selected to be displayed in the column. This value is displayed on the grid.

Examples

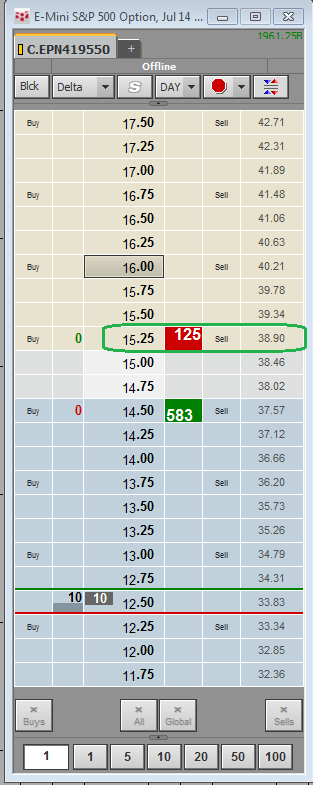

Enter C.EPN419550 on DOMTrader and select IV to be displayed in the column. Consider several IV values displayed on the grid. For example, for the best ask (OP1 = 12.50) we see IV=13.47:

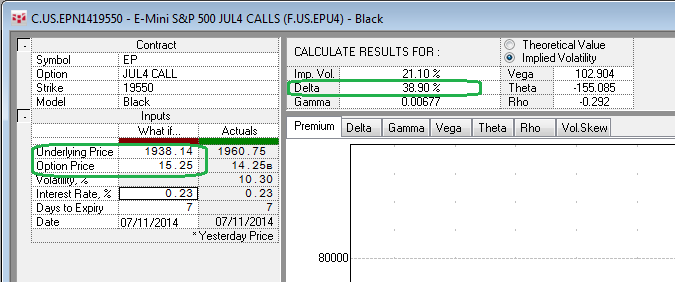

On the volatility curve, we see that the following point on the OP(UP) corresponds to OP = 12.50: UP = 1948.5264 (VOL = 0.1347, Displayed Greek = 13.47).

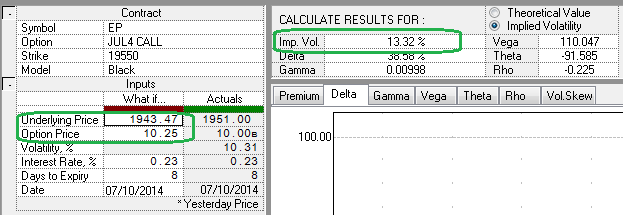

We can type these values of OP and UP in the “What if” pane of the Option Calculator and see that Imp. Vol. calculated for them is same there:

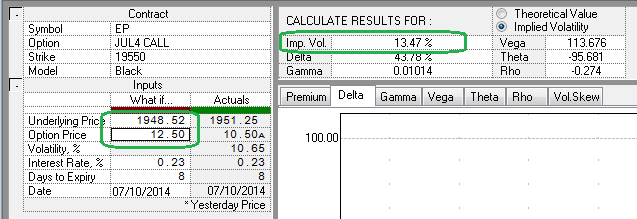

Let us take another row from the DOMTrader’s ladder, the top-most one, OP1 = 15.25:

Logs of the OP(UP) function yield UP = 1954.0018 (VOL 0.1364, Displayed Greek = 13.64).

Applying these values of UP and OP in “What if” calculator, we get exactly 13.64:

Finally, let us take the bottom-most option price from the grid:

UP = 1943.4720 (VOL 0.1332, Displayed Greek = 13.32)

“What if” confirms that 13.32 is correct value for these OP/UP pair:

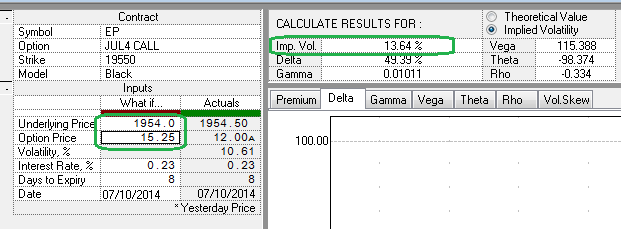

Situation with Greeks other than IV is the same: