Standard (Vanilla) Barrier

There are two kinds of the barrier options:

•In = Paid for today but first come into existence if the underlying price hits the barrier H before expiration.

•Out = Similar to standard options except that the option is knocked out or becomes worthless if the underlying price hits the barrier before expiration.

TheoV

In Barriers

Down-and-in call

|

c(X>=H) = C + E |

η = 1, φ = 1 |

|

c(X<H) = A – B + D + E |

η = 1, φ = 1 |

Up-and-in call

|

c(X>=H) = A + E |

η = -1, φ = 1 |

|

c(X<H) = B – C + D + E |

η = -1, φ = 1 |

Down-and-in put

|

p(X>=H) = B – C + D + E |

η = 1, φ = -1 |

|

p(X<H) = A + E |

η = 1, φ = -1 |

Up-and-in put

|

p(X>=H) = A – B + D + E |

η = -1, φ = -1 |

|

p(X<H) = C + E |

η = -1, φ = -1 |

Out Barriers

Down-and-out call

|

c(X>=H) = A – C + F |

η = 1, φ = 1 |

|

c(X<H) = B – D + F |

η = 1, φ = 1 |

Up-and-out call

|

c(X>=H) = F |

η = -1, φ = 1 |

|

c(X<H) = A – B + C – D + F |

η = -1, φ = 1 |

Down-and-out put

|

p(X>=H) = A – B + C – D + F |

η = 1, φ = -1 |

|

p(X<H) = F |

η = 1, φ = -1 |

Up-and-out put

|

p(X>=H) = B – D + F |

η = -1, φ = -1 |

|

p(X<H) = A – C + F |

η = -1, φ = -1 |

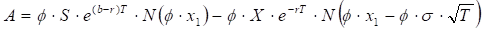

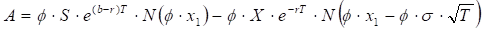

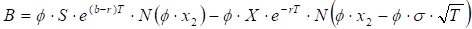

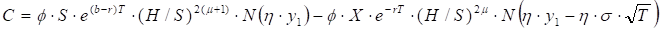

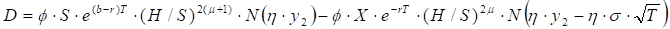

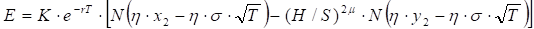

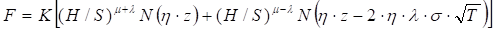

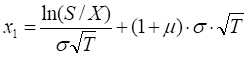

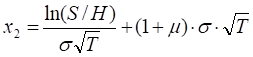

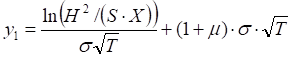

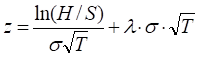

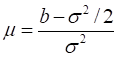

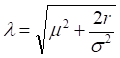

where

K – possible cash rebate,

b – the cost-of-carry

b = r to price options on stocks

b = r – q to price options on stocks and stock indexes paying a continuous dividend yield q

b = 0 to price options on futures

b = r – rf to price currency options (rf – risk-free rate of the foreign currency)

Delta, Gamma, Vega, Theta, Rho

The system uses the numerical differentiation to calculate the Greeks.

Implied volatility

The software shall numerically find implied volatility.

For further reading, we suggest:

•The Complete Guide to Option Pricing Formulas. ISBN 0071389970.

•Barrier Options, Binary/Digital Options, and Lookback Options at www.global-derivatives.com.