The Vasicek model (1977), and interest rate model, is a yield-based one-factor equilibrium model. The model allows closed-form solutions for European options on zero-coupon bonds.

TheoV

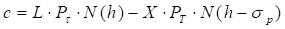

Call

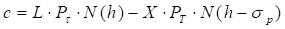

Put

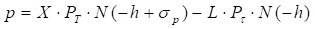

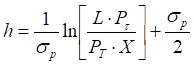

where

L – bond principal (i.e. face value),

τ – bond time to maturity,

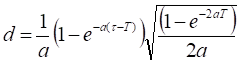

,

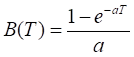

,

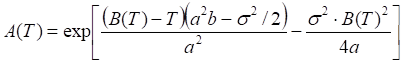

,

,

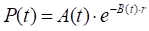

P(T)-the price at time zero of a zero-coupon bond that pays $1 at time T,

where

r – the initial risk-free rate

a – the speed of the mean reversion,

b – the mean reversion level.

Delta

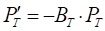

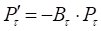

Since, Delta is the option value sensitivity to small movements in the underlying price then

Call

Put

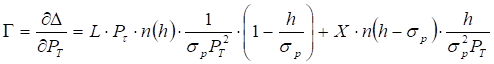

Gamma

Gamma is identical for put and call options.

Vega

System uses the numerical differentiation to calculate vega.

Theta

System uses the numerical differentiation to calculate theta.

Rho

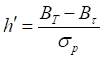

Since the price at time zero of a zero-coupon bond that pays $1 at time t is

then

then

where

,

,

Call

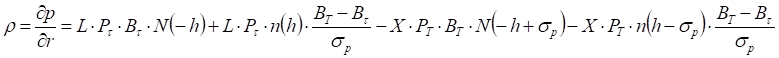

Put

Put

Implied volatility

System numerically finds implied volatility.