The quadratic approximation method by Baron-Adesi and Whaley (1987) can be used to price American options.

TheoV

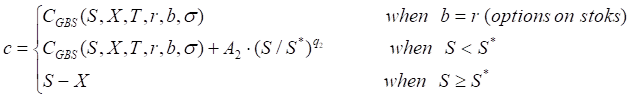

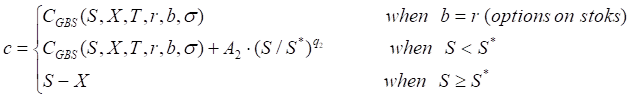

Call

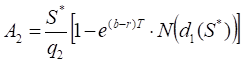

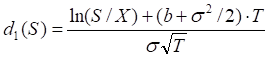

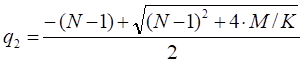

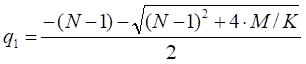

where

b – the cost-of-carry rate;

b = r to price options on stocks.

b = r – q to price options on stocks and stock indexes paying a continuous dividend yield q

b = 0 to price options on futures.

b = r – rf to price currency options (rf – risk-free rate of the foreign currency).

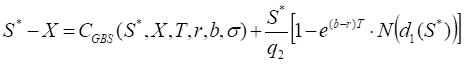

CGBS – the generalized Black-Scholes call TheoV expression;

S* – the critical commodity price for the call option that satisfies

The last equation should be numerically solved to find S*.

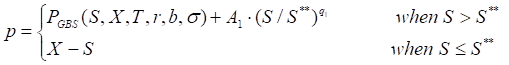

Put

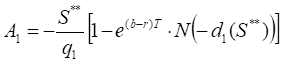

where

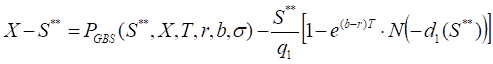

PGBS – the generalized Black-Scholes put TheoV expression;

S**– the critical commodity price for the put option that satisfies

The last equation should be numerically solved to find S**.

Delta

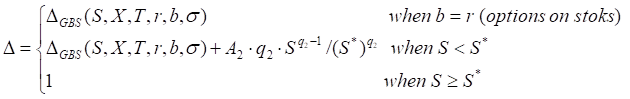

Call

where

∆GBS - the generalized Black-Scholes call ∆ expression.

Put

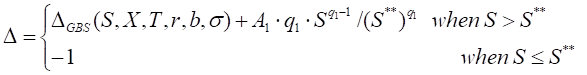

where

∆GBS - the generalized Black-Scholes put ∆ expression.

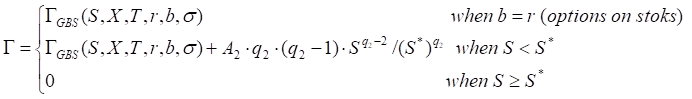

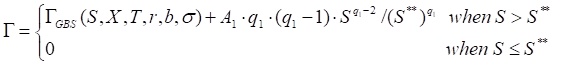

Gamma

Call

Put

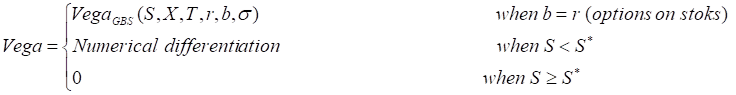

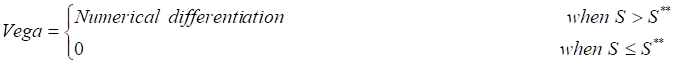

Vega

Call

Put

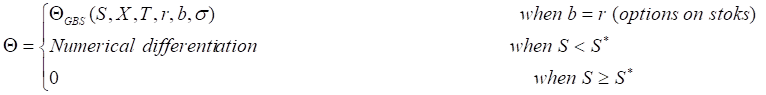

Theta

Call

where

ΘGBS - the generalized Black-Scholes call Θ expression.

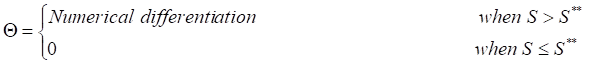

Put

where

ΘGBS - the generalized Black-Scholes put Θ expression.

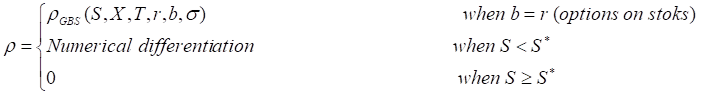

Rho

Call

where

ρGBS - the generalized Black-Scholes call ρ expression.

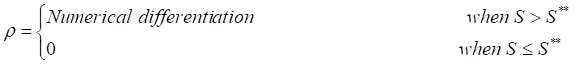

Put

where

ρGBS - the generalized Black-Scholes put ρ expression.

Implied volatility

System numerically finds implied volatility.

Implied volatility can’t be calculated for call option if option value is less than (underlying price - strike).

Implied volatility can’t be calculated for put option if option value is less than (strike - underlying).