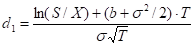

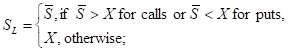

where

In a fixed strike lookback call, the strike is fixed in advance, and at expiry the option pays out the maximum of the difference between the highest observed price, Smax, in the option lifetime and the strike X, and 0. Similarly, a put at expiry pays out the maximum observed price, Smin, and 0.

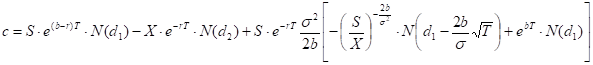

TheoV

Call

when X > Smax

where

b – the cost-of-carry;

b = r to price options on stocks;

b = r – q to price options on stocks and stock indexes paying a continuous dividend yield q;

b = r – rf to price currency options (rf – risk-free rate of the foreign currency);

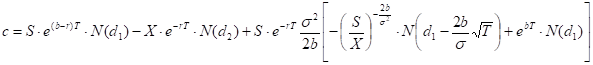

when X <= Smax

where

where

Put

when X < Smin

when X>=Smin

where

where

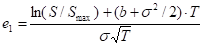

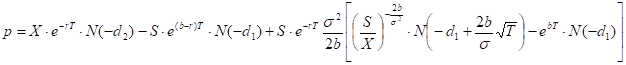

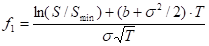

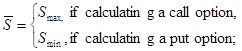

By defining the following variables all four formulas can be combined into one:

- option type adjustment,

- option type adjustment,

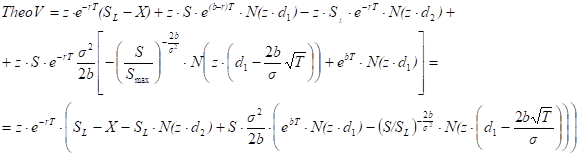

Now the formulas transform into:

Delta, Gamma, Vega, Theta, Rho

The system uses the numerical differentiation to calculate the Greeks.

Implied volatility

The systems finds implied volatility numerically.