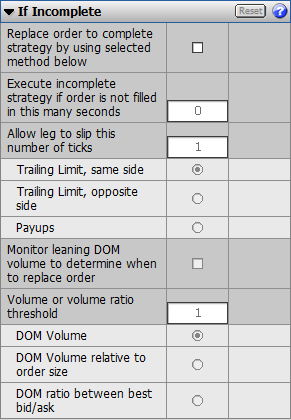

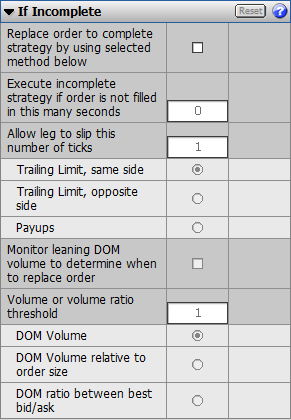

Using trading parameters, you can choose how the system handles incomplete orders.

|

Parameter |

Description |

|

Replace order to complete strategy by using selected method below |

Determines whether the system should react to incomplete orders. Used with trailing limits and payups to determine how incomplete orders should be handled (the incomplete strategy). If not selected, the system does nothing. Default = off. |

|

Execute incomplete strategy if order is not filled in this many seconds |

Indicates the amount of time that must elapse from acknowledgement before the incomplete strategy is executed. It allows you, for example, to wait a second to see if the market comes back. Default = 0. |

|

Allow leg to slip this number of ticks |

Indicates the maximum number of ticks of slippage for the incomplete strategy. Can be a positive or negative value. Also used for the offset value of payup orders, i.e. the number of ticks to modify when the payup condition (time and/or one of the leaning DOM volume options) is met. Default = 1. Trailing Limit, same side: places a trailing limit order that tracks the same side as the incomplete order. For example, if the sell side is incomplete, then it trails the offer. If the monitor DOM volume option is selected, the DOM condition must be met before trailing occurs. Trailing Limit, opposite side: places a trailing limit order that tracks the opposite side of the incomplete order. For example, if the sell side is incomplete, then it trails the bid. If the monitor DOM volume option is selected, the DOM condition must be met before trailing occurs. Payups: replaces the original limit order to complete the spread with a limit order that has the price adjusted based on number of slip ticks. The replacement can happen based on one of the specified conditions either timeout or DOM volume. |

|

Monitor leaning DOM volume to determine when to replace order |

Determines whether the system should monitor leaning DOM volume. This condition must be met before the unfilled order is modified (either payup or trail it). Default = off. |

|

Volume or volume ratio threshold |

Contains an absolute volume if DOM Volume is selected or a volume ratio if DOM Volume to relative to order size or DOM ratio is selected. Default = 1. DOM Volume: uses the threshold parameter as an absolute volume (allowed values 1-9999). When the leaning leg volume available at the exchange (best bid/ask, as appropriate for a leaning sell/buy order) drops below this specified volume, then the system performs a payup (replaces the original limit order to complete the spread with a limit order that has the price adjusted based on specified number of slipped ticks) or a trailing limit. DOM Volume relative to order size: uses the threshold parameter as a volume ratio (allowed values 0.1 – 999.9). When the ratio between the volume available at the exchange (best bid/ask, as appropriate for a leaning sell/buy order) and the leaning leg order size falls below the specified ratio, then the system performs a payup (replaces the original limit order to complete the spread with a limit order that has the price adjusted based on specified number of slipped ticks) or a trailing limit. DOM ratio between best bid/ask: uses the Threshold parameter as a volume ratio (allowed values 0.1 – 999.9). When the ratio between volumes available at the exchange (best bid/ask for a leaning sell order, best ask/bid for a leaning buy order) falls below the specified ratio, then the system performs a payup (replaces the original limit order to complete the spread with a limit order that has the price adjusted based on specified number of slipped ticks) or a trailing limit. |

An incomplete order results when:

•the price of the second leg cannot be met

•the first leg was filled at an undesirable price forcing execution of the second leg

Your incomplete order strategy depends on the market you’re trading. If you anticipate:

•a high volatility, non-directional market, then a trailing limit order may be best because you are more likely to fill at your desired price than with a payup.

•a high volatility, directional market, then a payup may be most effective.

•a low volatility market, then you may choose not to set up an incomplete strategy because you have a good chance to execute at your desired price.

Queue holders might also interest traders looking to manage trades in less volatile markets.