This image shows parameters for the single working leg. If you have all legs working, then parameters are displayed for all legs.

|

Parameter |

Description |

|

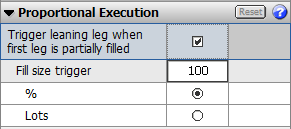

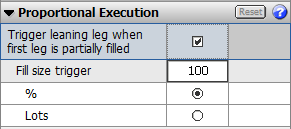

Trigger leaning leg |

Used with ratio spreads. Clear this check box to prevent proportional execution. You would choose to prevent proportional execution in situations where you do not want the first lot of the secondary leg placed until all lots are filled on the primary leg. For example, consider a 5:3 strategy. Disabling proportional execution allows the system to fill all five lots before the three lots are triggered. |

|

Fill size trigger |

Indicates how many contracts (lots or percent) should be filled before the second leg order is placed. For example, you’re working 10 lots of TYA and leaning on 1 million of BTC. If this setting is 50%, then the BTC leg order should be placed when 5 lots of TYA have been filled. Choose between lots and percentage. Default = 100%

Using "Fill size trigger" < 100% in "Avoid Overfills" mode may lead to a strategy fill at a price which is slightly worse than the limit price. In this case the strategy order will continue to work its primary order if it gets a partial fill (instead of placing a new hedging order at a fixed price and canceling the primary order, as it has a minor chance to overfill). And then, if the best price on the observed market changes, the price of the primary order can also change leading to partial fills at different prices which won't be hedged as the secondary order has already been placed/filled.

For example, consider a 2:1 strategy (A-B) with the Fill Size trigger = 50%, Buy 1@10. 1 lot is filled on the 1st leg (working) at 100. The strategy order will behave differently depending on the overfill handling mode:

1. No action on overfill or Auto Hedge Overfills. SELL 1@90 is placed to the 2nd leg and since this leg is closed completely, an additional order to BUY 1@100 is placed to the 1st leg and the existing (working) order is canceled. It can cause an overfill because 2 lots will be open on the 1st leg during some short period of time until the working order is canceled. 2. Avoid overfills. SELL 1@90 is placed to the 2nd leg and the remaining 1 lot continues to work on the 1st leg. No overfill is possible. However, if the observed market (on the 2nd leg) changes, then the price of the order on the 1st leg will change too, and it will be possible to get another partial fill at a different price, e.g. 1@110. In this case the final price of the strategy fill will be (100+110)/2 - 90 = 15. |