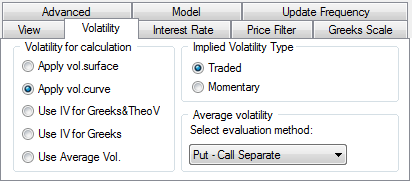

Volatility settings allow you to set the implied volatility type, evaluation method for average volatility, and select a volatility calculation type.

Volatility for calculation

Select one of:

•Apply vol surface = 3-D value from Volatility Workshop

•Apply vol curve = 2-D value from Volatility Workshop

•Use IV for Greeks&TheoV = Used in conjunction with the Implied Volatility Type, Traded or Momentary.

•Use IV for Greeks = Used in conjunction with the Implied Volatility Type, Traded or Momentary.

•Use Average Vol = Used in conjunction with the Average Volatility evaluation method.

The average volatility using Put-Call Separate and Put-Call Combined is calculated by taking a weighted average of the 2 implied volatilities for the strikes encompassing the at-the-money-strike.

For example, with the underlying at 1392.00 and the implied volatility of the 1390.00 calls at 26.02 and the implied volatility of the 1395.00 calls at 25.42 the average call volatility would be: .6(26.02) + .4(25.42) = 25.78. This volatility would be used to value all the calls. The average put volatility would be calculated the same way and that value would be used to value the puts. If the Put-Call Combined choice were selected, the call volatility and put volatility would be averaged and that volatility would be used for all the options series of that particular underlying.

Theoretical value cannot be calculated using implied volatility. If you select the Use implied volatility checkbox, CQG uses implied volatility to calculate all the values except theoretical value, where it uses one of the selections from the drop-down list: Put-Call Separate, Put-Call Combined or Historical. However, if the Use implied volatility box is not selected, all the values are calculated using one of the three methods.

Implied Volatility Type

Select one of:

•Traded = Matches the options price with the underlying price, based on a time when the two prices were in sync, that is, the options price happened no later than 3 hours after the underlying price. This could lead to a value that is in sync but not current.

Using this value involves taking the synced underlying price (also referred to as the coherent underlying price), which is the close of the underlying instrument during the minute prior to the last option tick. However, if the underlying has not traded during this minute, the system uses the underlying tick closest to the time of the option trade, as long as it happened during the current trading day. If the options price is a closing value, the settlement price for the underlying is used as the coherent underlying price.

•Momentary = Matches the options tick with the nearest tick in the underlying, even if the underlying trade happened after the options price. Volatilities calculated this way may be off by a large amount if the underlying trade took place substantially before or after the options trade.

If you select this value, the calculation uses the most current underlying price and the most current options price. Volatilities calculated this way may be off by a large amount, if the underlying price has changed significantly since the last options tick. In other words, momentary implied volatility takes the most current underlying tick without matching it to the time of the options. This may or may not result in the same volatility as the traded implied volatility.

These selections are global, which means they apply to all models. (Implied volatility selections made on the Model tab are only relevant to the selected model.)

Average volatility

Select one of:

•Put-Call Separate = Two values, one for the calls and one for the puts, are calculated and given separately. These values are then used as the volatility input for the selected options model.

•Put-Call Combined = The separate call and put volatilities are averaged together and one value is given. This value is then used as the volatility input for the selected options model.

•Historical Volatility = Represents the standard deviation of a series of price changes measured at regular intervals. You define the Historical Volatility using either Percent or Logarithmic price changes. Percent changes assume that prices change at fixed intervals. Logarithmic changes assume that prices are continuously changing. Historical Volatility requires a period value. Constant value requires a percentage value.

•Constant Volatility = If selected, you must also select a percentage for the volatility. For example, if the selected contract was trading at 1300 and the volatility value selected was 10%, you would be implying an underlying price of 1300+ or - 10%, i.e., 1170-1430 over the next year.