You can use options models to derive the implied underlying price and implied volatility by weighting strategies.

The selected options model with all inputs except underlying price is seeded as a start value. Next, the system uses a search algorithm to find the underlying price that satisfies the option value observed in the market. This is the same method used to find implied volatility. For average implied values, there are a number of averaging methods that may be employed.

The procedure is the same for both Implied Volatility and Implied Underlying.

1. Click the Setup button.

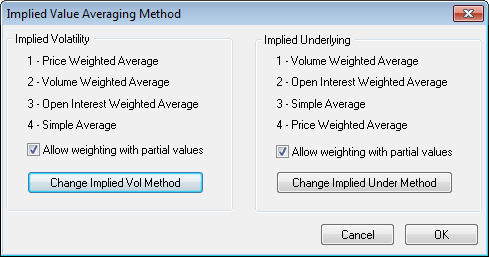

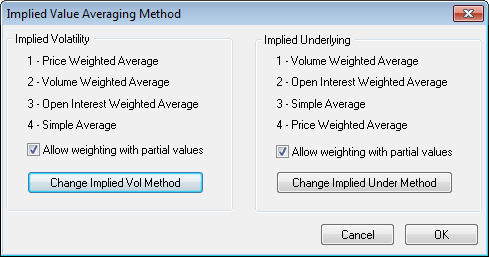

2. Click Weights. The Implied Value Averaging Method window opens. The current order of values is displayed on the window.

3. Select the Allow weighting check box.

4. Click the Change Implied Method button.

5. On the Select Methods window, order the values.

6. Click OK.

This method places the greatest emphasis on contract with the greatest daily volume. The greater the volume traded for the option in question, the more weight is given to the option’s implied value. When using this method, one assumes that the current trading activity is most relevant in a determination of market behavior. Specifically, for n number of trades, each with a separate open interest, the method would be used as follows:

|

Variable |

Definition |

|

VOL1 |

Volume for trade 1 |

|

VOL2 |

Volume for trade 2 |

|

VOLn |

Volume for trade n |

|

UP1 |

Implied underlying price for trade1 |

|

UP2 |

Implied underlying price for trade 2 |

|

UPn |

Implied underlying price for trade n |

|

AUP |

Average implied underlying price for the strategy |

|

TOI |

Total open interest for all trades. |

The average is the sum of each implied underlying price for each trade weighted by its proportion of the total volume for all trades:

AUP = [VOL1/(AUP * UP1)] + [VOL2/(AUP * UP2)] + [VOLn/(AUP * UPn)]

This method places emphasis on open interest for the option contract. More weight is given to the implied values derived from options with the greatest open interest. An underlying assumption when using this method is that the interest in a contract requires holders of that contract to adjust their positions in accordance with their market expectations. A large open interest on a low volume suggests that the contract holders are satisfied that the option is correctly valued in the market and that adjustments are not in order. Therefore, volume is not required to justify the importance of the contract with respect to the market. Specifically, for n number of trades, each with a separate open interest, the method would be used as follows:

|

Variable |

Definition |

|

OI1 |

Open interest for trade 1 |

|

OI2 |

Open interest for trade 2 |

|

Oln |

Open interest for trade n |

|

UP1 |

Implied underlying price for trade1 |

|

UP2 |

Implied underlying price for trade 2 |

|

UPn |

Implied underlying price for trade n |

|

AUP |

Average implied underlying price for the strategy |

|

TOI |

Total open interest for all trades. |

The average is the sum of each implied underlying price for each trade weighted by its proportion of the total open interest for all trades:

AUP = [OI1/(AUP * UP1)] + [OI2/(AUP * UP2)] + [OIn/(AUP * UPn)]

This method places the greatest emphasis on the series that is closest to at-the-money. The closer the option strike is to at-the-money, the more weight is given to the implied value from the option. Conversely, the further out-of-the-money the strike is, the less weight is given to the implied value from the option. For example:

|

Strike Price |

Strike |

Underlying |

Strike - UP |

Volatility |

|

Trade 1 |

2000 |

2250 |

250 |

20 |

|

Trade 2 |

The lowest strike for the strategy. |

2250 |

150 |

22 |

|

Trade 3 |

2200 |

2250 |

50 |

24 |

|

Trade 4 |

2300 |

2250 |

50 |

26 |

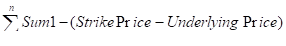

-----In other words, the sum of

column 4. = 500

-----In other words, the sum of

column 4. = 500

Sum2 =  = (500 – 250) + (500 –

150) + (500 – 50) + (500 – 50) = 1500

= (500 – 250) + (500 –

150) + (500 – 50) + (500 – 50) = 1500

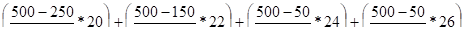

Price Weighted Average Implied Volatility =  * Volatility

* Volatility

Therefore, Price Weighted Average Implied Volatility =

=

=

3.33 + 5.13+ 7.2 + 7.8 = 23.46

This method is most useful for averaging Implied Volatilities. For averaging Implied Underlying Prices this makes less sense, since the proximity of a strike to the underlying price is in doubt.

This method applies no weighting.