Market Taking mode indicates that your order is held on the gateway server until your price becomes available in at least one market; at which time, the gateway server sends an order to the exchange.

|

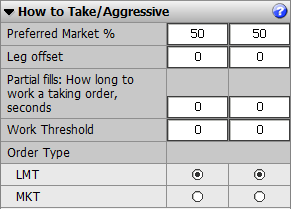

Parameter |

Description |

|

Preferred Market % |

Allows you to specify how many lots are placed on each leg provided there is sufficient volume at your target price. In the event that there is NOT sufficient volume at your target price in one or more legs, this preference is ignored, and the gateway server attempts to fill your order at your target price without regard to market preference. The allocations for Market Taking can be different from those set for Market Making. The allocations for Market Taking must equal 100%. The default is 50% – 50%. |

|

Leg offset |

Specifies number of ticks to move a leg order from computed price further from market. |

|

Partial fills: how long to work a taking order |

Allows you to set how long to work a taking order. This parameter, set independently for each leg, controls the amount of time that the gateway server allows a taking order to work (after exchange acknowledgment) before considering it timed out (and thus canceling it). Default = 0. Zero means that the gateway server never cancels an unfilled taking order. |

|

Work Threshold |

This parameter, set independently for each leg, defines a threshold quantity that the gateway server ignores for purposes of determining available quantity on that leg. (e.g. If the best ask is 10 @ 8 and the threshold quantity is 10, then the gateway server treats the best ask as 0 @ 8 and does not place any taking orders on that leg.) |

|

Order Type |

This parameter, set independently for each leg, controls the order type (LMT v. MKT) that the gateway server uses for any taking order. |