The Intraday Momentum Index (IMI) is a technical indicator developed by market technician Tushar Chande to assist traders and investors with their trading decisions.

The indicator combines aspects of candlestick analysis with the relative strength index (RSI) calculation in order to generate overbought or oversold signals.

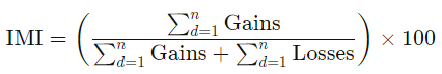

Where:

Gains = CP − OP on Up Days, i.e., Close > Open

CP = Closing price

OP = Opening price

Losses= OP − CP on Down Days, i.e., Open > Close

d = Days

n = Number of days (14 is commonly used)

|

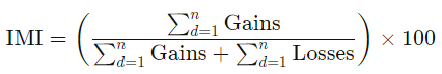

Parameter |

Description |

|

Display |

Opens sub-window to set parameters •Color = Line color. •Weight = Line thickness. •Display = Line style: line, dashed, dotted, gapopen, gapdotted or histogram. •ShareScale = Determines whether sharing of the vertical scales between studies is accepted. Auto = System determine whether sharing is feasible. On = Scale is shared regardless of the functions and studies displayed. Off = Scale is not shared. ShareScale must be On if study is overlaid on a study with multiple outputs. |

|

MarkIt |

Opens Specify Conditions window. |

|

Period |

Number of bars in the lookback range. |

|

OB/OS |

Opens sub-window with overbought and oversold parameters: •Color = Select a color for the line. •Weight = Choose a thickness for the indicator. •Type = Choose fixed or dynamic. Fixed = uses Level as a fixed OB/OS value. Dynamic = uses Standard Deviation and Lookback for a dynamic OB/OS value:. OB: MA(@,Sim,lookback) + factor * STDDEV(@,lookback) OS: MA(@,Sim,lookback) - factor * STDDEV(@,lookback) where @ is the study •Std Dev = Multiplier used to calculate high and low. •Lookback = Number of bars to compare to the current bar. •Level = Percentage of average OB/OS used to calculate predictor Ob/OS levels. •Display = Click this check box to display the component. •Style = Choose a line style. |