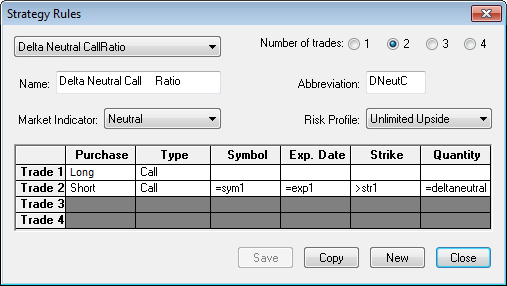

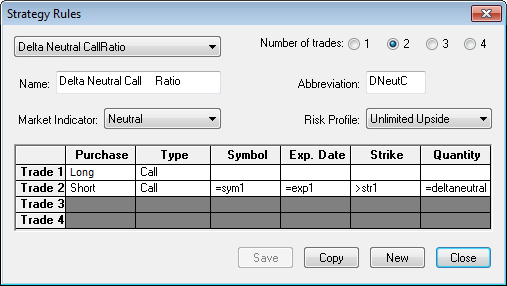

The Strategy Rules window displays the trade components of a strategy and gives a brief description of the market expectations appropriate for the strategy and the risk characteristics associated with the strategy.

You can create new strategies as well as edit previously created strategies.

To open this window, click the Rules button.

The Purchase (long or short) and the trade Type (call, put or underlying) must be defined for each trade.

|

Parameter |

Description |

|

Strategy list |

Lists all strategies. |

|

Number of trades |

Number of trades in the strategy. |

|

Name |

Name of strategy. Must be unique. |

|

Abbreviation |

Abbreviation of strategy name. Must be unique. |

|

Market Indicator |

Shows market expectation underlying the strategy. Values: Strongly Bearish Bearish Mildly Bearish Neutral Mildly Bullish Bullish Strongly Bullish Volatile |

|

Risk Profile |

Provides a brief description of the level and direction of risk associated with each strategy. Values: Limited Unlimited Upside Unlimited Downside Unlimited |

|

Trade: Purchase |

Side of trade. Must be defined. |

|

Trade: Type |

Call or Put. |

|

Trade: Symbol |

For single trade strategies, no symbol is needed. For strategies with multiple trades, the first symbol cell is blank, and the others contain =sym1. |

|

Trade: Exp. Date |

For single trade strategies, no expiration date is needed. For strategies with multiple trades, the first symbol cell is blank, and the others contain either =exp1 for a contract with the same expiration date, <exp, if the second expiration date is earlier than the first contract, or >exp, if the second expiration is further out than the first contract’s expiration date. |

|

Trade: Strike |

For single trade strategies, no Strike price is needed. For strategies with multiple trades, the possible strike price inputs and their definitions are as follows: =high (highest strike for the strategy) =low (lowest strike for the strategy) =str1 (equals strike price #1) >str1,2,3 (greater than strike price 1, 2, or 3) <str1,2,3 less than strike price 1, 2 or 3) ! The Exclamation sign is used to require that strike of the second trade shall be not equal to the strike of the first trade (it may be less, may be greater, but not equal to it). Same syntax may be used for expiration date if needed. |

|

Trade: Quantity |

For the first trade, whether a single or multiple trade strategy, no quantity is needed. Other quantities are expressed as a comparison with the first quantity. Example: qty*2 |

If a cell has no rule defined, there is no restriction on data entry in the corresponding trade entry box of the Strategy window. When a rule is given, it must define the data entry with respect to a previous trade’s data of the same type as the rule being entered. For instance, a symbol rule can be “=sym1” or a strike rule can be “>str2”.

To copy an existing strategy

When creating a new strategy, the Copy button can be used to copy an existing strategy. Modifications can be made to the name, abbreviation and rules.

1. Select a strategy using the drop- down list button.

2. Click the Copy button.

The new strategy is exactly the same as the old one, except the name has Copy in the front.

To edit an old strategy

1. Click the drop-down list under Purchase.

2. Select either Long (for buys) or Short (for sells).

3. Click the drop-down list under Type.

4. Select either Call, Put or Underlying.

To create a completely new strategy

1. Click the Rules button.

2. Click the New button.

3. Select the radio button indicating the number of trades in the strategy.

4. Enter a name and an abbreviation for the study.

5. Select a Market Indicator from the drop-down list.

6. Select a Risk Profile from the drop-down list.

7. Click the drop-down list under Purchase.

8. Select either Long (for buys) or Short (for sells).

9. Click the drop-down list under Type.

10. Select either Call, Put or Underlying.

11. Enter a Symbol: