Note for users of the Volume study: Beginning with version 16.10, custom formulas that use VolBid or VolFiltBid will use VolBidNeg or VolFiltBidNeg instead. With this new version, VolBid is calculated as a positive value, while VolBidNeg values are negative. By updating the study components used in custom formulas, we ensure that the outputs remain intact.

This study displays actual volume or tick volume either by total trades or bid/ask.

•Tick Volume: Represents the number of inside price changes, i.e. the count of how many times a last price has been changed over a time period.

•Actual Volume: Represents the total number of contracts traded during the selected chart interval. The actual volume for the current day is updated when the volume information becomes available from the exchanges. The exchanges transmit volume information at different times. Therefore, when users request volume for the current day, only tick volume may be available.

For users receiving DDA data: For intraday charts, the volume study defaults to Actual if trade volume is being sent, otherwise the study defaults to Tick. Additionally, cumulative volume (reported by Eurex for certain contracts) is reported as netted volume, calculated by taking the difference between each cumulative volume figure sent by Eurex.

•Auto Volume: Tells the system to automatically switch from tick volume to actual volume when actual volume is available.

Volume amounts can be filtered with a volume threshold.

Volume is used as a qualifier when interpreting patterns and other technical indicators. High volume events give more importance to underlying activity. Divergences between price action and volume are often used to predict future price activity. Volume is useful in identifying tops and bottoms of trends. An uptrend that shows volume trending lower may predict its conclusion, while a downtrend with waning volume and high volume event(s) may predict a reversal.

This study can be applied to all chart types.

Volume Parameters

|

Parameter |

Description |

|

Display |

Opens sub-window to set parameters for Vol, Vol: Total, Vol: Filtered Total, Vol: Ask, Vol: Bid, and Vol: Filtered Bid: •Display = Line style: line or histogram. •Color = Line color. •Weight = Line thickness. |

|

MarkIt |

Opens Specify Conditions window. |

|

Highlight |

Values: •Total Trades •Bids/Asks (histogram) •Delta = difference between bid and ask •Delta Momentum = accumulation of previous deltas, directly relates to volume and order flow, more pure data point •Delta Day = net order flow for the day, running total of delta used to look for inverse relationships in the market. |

|

Volume Threshold |

Volume filter. All trades with volumes greater than this value are treated as large, from 0-1000000. Must be enabled for this parameter. |

|

Type |

Volume type. Values: •Exchange Only = total number of contracts traded during the selected chart interval. •Tick Only = number of inside price changes, i.e. the count of how many times a last price has been changed over a time period. •Exchange or Tick = exchange volume is used if it’s available, otherwise ticks are used. |

|

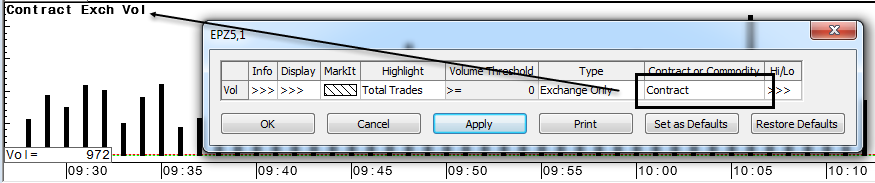

Contract or Commodity |

Values: •Auto = existing volume type •Contract •Commodity |

|

Use Aggressor Flag |

If checked then if a trade does not have the aggressor indicator then it shall be ignored for the calculation. |

|

Hi/Lo |

Opens sub-window for parameters for Hi and Lo: •Color = Line color. •Weight = Line thickness. •Level •Display = If selected, component is displayed. •Style = Line type: line, long dash, short dash. |

|

Start From |

Used with Highlight = Delta Momentum and Highlight = Delta Day. Select Start of Day or Start of Session. |

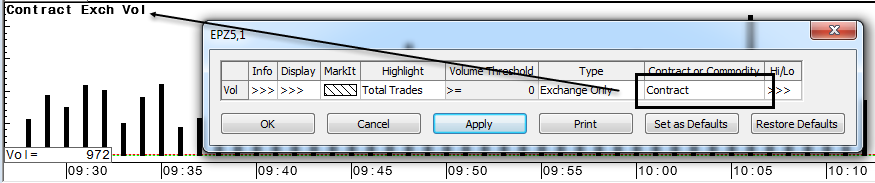

Volume Study Display

When total trades are highlighted, the type of volume used in the calculation is indicated on the study label, like this:

Volume is displayed as a histogram at the bottom of the chart.

When Bids/Asks is selected for the Highlight parameter, the cursor value box contains VolAsk and VolBidNeg.

These outputs are available in the Formula Toolbox:

•Vol = total actual or tick volume

•VolFilt = filtered total volume (actual volume of trades greater than the given threshold)

•VolAsk = volume of trades made on ask side

•VolFiltAsk = filtered ask volume (actual volume of trades made on the ask side greater than the given threshold)

•VolBidNeg = volume of trades made on the bid side as a negative number

•VolFiltBidNeg = filtered bid volume as a negative number

•VolBid = volume of trades made on the bid side

•VolFiltBid = filtered bid volume (actual volume of trades made on the bid side greater than the given threshold)

It is recommended that you use VolAsk and VolBid outputs in custom studies, so that they can be applied to irregular charts, unlike AskTradeVol and BidTradeVol.

•VolAsk = volume of trades made on ask side

•AskTradeVol = executed volume at the ask price

•VolBid = volume of trades made on bid side

•BidTradeVol = executed volume at the bid price as a positive number

Volume Study Calculation

Trade volume is associated with a bid or ask side in this way:

•If the trade is less than or equal to the best bid, all of its volume is associated with the bid.

•If the trade is greater than or equal to the best ask, all of its volume is associated with the ask.

•If best bid and best ask are equal or crossed and the trade has occurred, half of its volume is associated with the bid and half with the ask.

•If the trade is less than the best ask and greater than the best bid, its volume is split between bid and ask inversely proportional to the distances to best bid/best ask, i.e. the closer the trade is to the best bid, the higher the quantity associated with the bid.

Fractional volume is rounded to the closest integer (standard mathematics).

Filtered trade volume for a bar is calculated as the sum of the ask/bid/total volumes of trades inside the bar, with the actual volumes greater than or equal to the given threshold.

Consecutive trades are considered as one large trade if all of the following conditions are met:

•They all happened on the same side (bid or ask).

•There were no intervening opposite side trades among them (trade that is split between bid and ask is not considered intervening).

•They happened within 50 milliseconds of each other (TFlow only).

•No BBA updates occurred between trades.

If a large trade contains trades from several bars, its volume is assigned to the last bar.

If a trade is associated with the bid or ask side, the tick corresponding to this trade is associated with the same side. If a trade is divided between both sides, then the corresponding tick is divided between sides in the same proportion. Ticks assigned to bid and ask sides are accumulated in the VolBid and VolAsk outputs.

Filtered tick volume is calculated as sum of ticks corresponding to:

•single trades, not recognized as large trades, with volume greater than or equal to the given threshold, and

•large trades with volume greater than or equal to the given threshold.

The Volume study works with most chart types (bar, candlestick, equalized sessions, fill gap, line, no gap, percent bar, tick, TFlow, time-based TFlow, yield, BarXData, CVBXData, and TFXData). Total actual and tick volume are calculated for historical charts and for point and figure charts built from bars. Total actual, bid, ask, and tick volume are calculated for point and figure charts built from ticks.