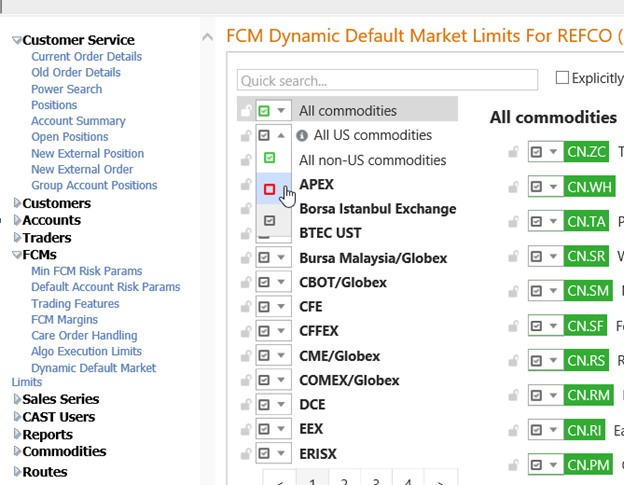

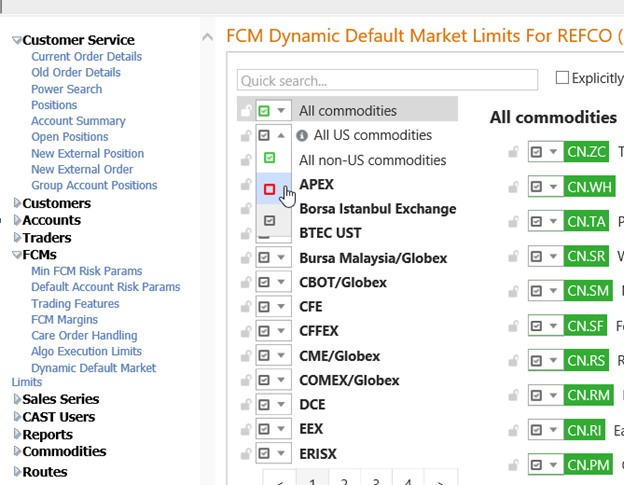

Here, an FCM can set default settings for all accounts to “Enable Trading”, “Prohibit Trading”, or set to “Allowed to trade is inherited from a higher level” for All or Individual exchanges, commodities, contracts and instruments. In addition, while the settings for individual exchanges, contracts and instruments can be managed here these settings can on a case-by-case basis be set to override the default settings.

There is a checkbox next to All commodities, All US commodities, All non-US commodities, the exchanges, commodities, instruments and contracts. If you click on the dropdown next to the checkbox for “All commodities” you will see a green square and a red square. This is an explicit setting. Checking the green boxes enables trading for all commodities. Checking the red box prohibits trading for all commodities. However, these settings can be overridden on an individual basis down to the contract settings.

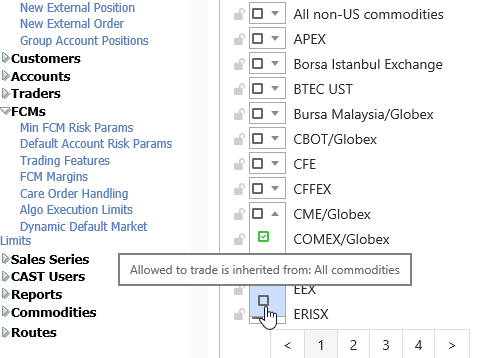

All other checkboxes have the green (enabled), red (prohibited) plus a third checkbox, which is grey and the setting is: “Allowed to Trade is inherited from: Source.” Source is the higher level setting, such as All commodities. If you selected the green checkbox for “All commodities” then all of check boxes would be grey You would see: “Allowed to Trade is inherited from: All commodities.”

An FCM could prohibit trading on all exchanges (select the red checkbox) and then enable individual exchanges, individual commodities, etc. All other exchanges will show the grey (Allowed to Trade is inherited from: All commodities.) checkbox. And, because all commodities are prohibited from trading then the grey checkbox indicates this exchange, commodity, etc., is prohibited from trading.

When making updates to the settings be sure and click “Save” over on the right-hand corner of the display.

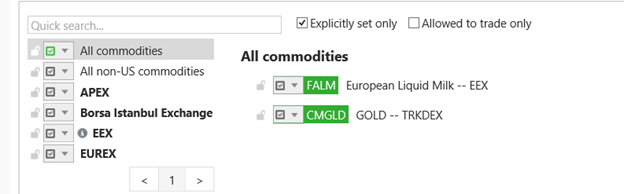

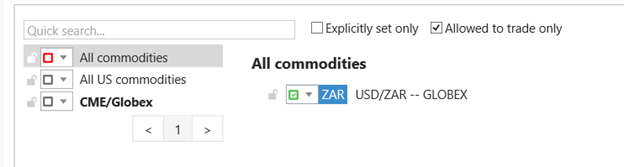

There are two filters at the top: “Explicitly set only” and “Allowed to trade only.” Selecting “Explicitly set only” will display a list of those Instruments that have an explicit setting such as a price limit under Trade Price Limits that is not set to “Inherited.”

Selecting “Allowed to trade only” will produce a list of those instruments enabled for trading. Below “All commodities” are prohibited but symbol ZAR was set to enabled for trading.

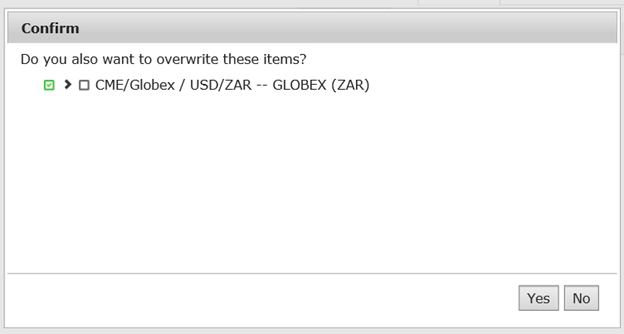

If you set, for example, some instruments enabled for trading and then set the exchange prohibited from trading a confirmation window will open to confirm overwriting the current instrument enabled settings and use the inherited settings.

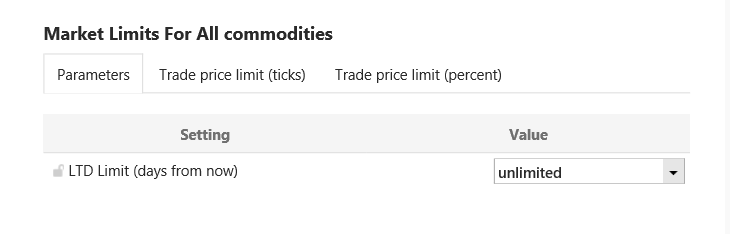

Setting Market Limits has three tabs: Parameters, Trade price limit (ticks) and Trade price limit (percent). The Parameters tab has been added to the Dynamic Default Market Limits page. The setting LTD Limit (days from now) allows you to prohibit trading if the last trading day is more than N business days from today. You can make this setting for “All commodities” and then set it individually for exchanges, commodities, and instruments (not for contracts).

Last trading day limit (not for contract) N next business days can be set to unlimited, inherited or if you select limited you will be prompted for a value. This setting can be locked at the FCM level and the Account Market Limits page cannot override the setting.

“Business days” includes holidays; that is, holidays are considered regular business days in this calculation. Additionally, instrument cutoff time is used, so a day is calculated from the exchange’s point of view, not UTC.

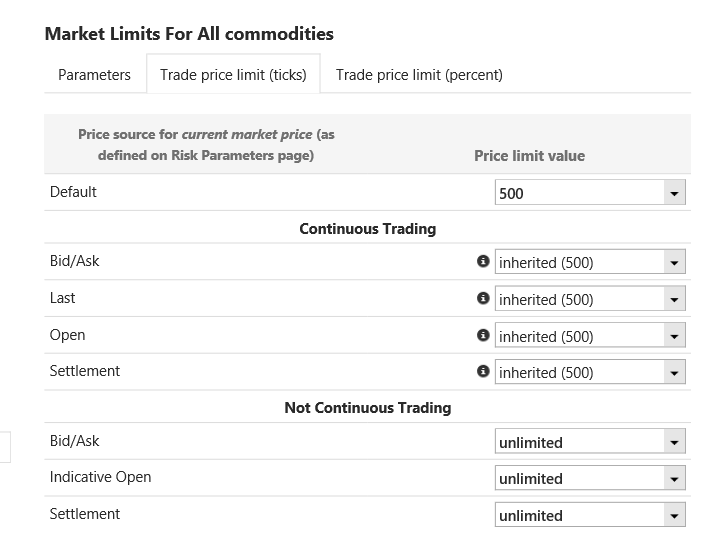

Setting the Market Limits (below, the setting is for All Commodities) begins with the choice of setting a Default value, here it is set to 500 ticks. Then, you can alternatively use the Default setting or a different setting by selecting from the drop down menus either Inherited (again, set to 500), Unlimited, i.e. no value, or you can enter in a unique value. If you use Trade Price Limit (Percent) then 1 = 100%.

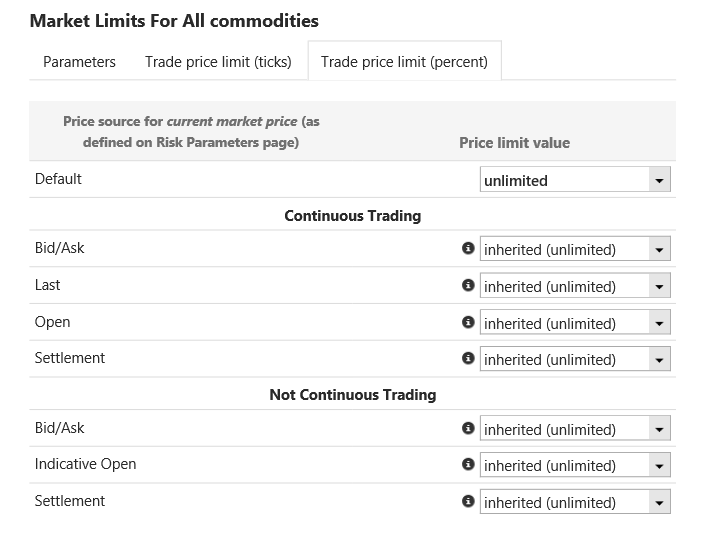

The Trade Price Limit check compares an order’s price against an allowed price range using the “current market price.” The “current market price” is defined as:

1. Bid/Ask

2. Last

3. Open

4. Settlement

This is a fixed priority list for the check. The first available price in the above list is used to define the “current market price.” Any lower values in the list are not considered for the price limit check.

The configured limit for the first qualifying “current market price” (as well as the current market state, i.e. continuous trading or not continuous trading) is applied to determine the acceptable range. Next, the order is checked against that range. If the order price is outside of the range, the order is rejected.

Continuous Trading is the market is open. Not Continuous Trading is anything other than continuous trading, including pre-open, halt, close, auction.

Setting a Default, such as 500, is then available in the Accounts>Risk Parameters page as well as relevant places on Accounts>Market Limits page.

Here is an example of a collection of settings for all commodities where the values are inherited from the Default value.

Hover the mouse over the “i” next to the setting and you will see the source of the setting value. The limit value is inherited from the Default value.

Selecting the Trade price limit (percent) works the same way. If you use Trade Price Limit (Percent) then 1 = 100%.

Permissions associated with this page

CAST Users > CAST Permissions > Risk Management > FCM > View Default Account Risk Parameters

CAST Users > CAST Permissions > Risk Management > FCM > Modify Default Account Risk Parameters

CAST Users > CAST Permissions > Risk Management > FCM > View Minimum FCM Risk Parameters

CAST Users > CAST Permissions > Risk Management > FCM > Modify Minimum FCM Risk Parameters