This page is used to set margins for instruments and manage exchange exposure considering margins exposed by clearing houses. You can assign margin limits for instruments by FCM and then switch those limits on or off by account.

For derivative instruments, margin is calculated by variable currency type:

This margin value must be a positive decimal value.

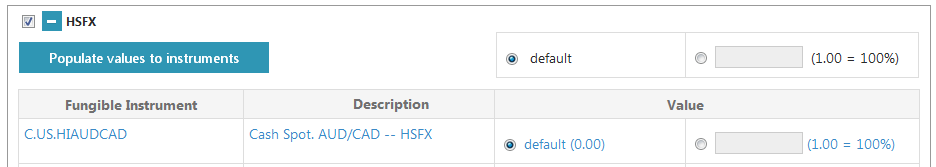

For cash spot and equities instruments margin is specified in percent (%), like this:

0.1 = 10%

1 = 100%

Allowed values are 0.0 to 10.0 (1000%).

Once these limits are set, they are enabled or disabled for a particular account on the Risk Parameters page on the Accounts menu.

When these instrument-specific margins are enabled, total margin risk is calculated as

instrument margin * number of lots

instead of using the default margin value or any other risk algorithms.

Note: No changes are made to the FCM’s minimum and default risk parameters.

To set instrument margins

You can set margin limits for all US or non-US instruments, for a particular exchange, or for a particular instrument.

1. Go to FCMs > FCM Margins..

2. To enter a specific margin value for all non-US or all US instruments, click the button near the empty price field and type a value.

3. Click the Populate values to instruments button to assign this margin value to all instruments in this group.

4. To set limits by exchange, click the + button to the left of the exchange name, and then click the button near the empty price field and type a value.

5. Click the Populate values to instruments button to assign this margin value to all instruments offered by this exchange.

6. To change limits for a particular instrument on an exchange, go to that row, then click the button near the empty price field and type a value. Percent values: 0.1 = 10% and 1 = 100%

7. Click Save.

Permissions associated with this page

CAST Users > CAST Permissions > Risk Management > FCM > View FCM Margins

CAST Users > CAST Permissions > Risk Management > FCM > Modify FCM Margins