Auto Trade parameters are arranged in columns on the Auto Trade window.

|

Name |

Description |

|

Name |

Type an alert name, which appears as a filter on the Orders and Positions window and with the ATS study. This is the first step in the process of creating an auto trade; other fields are active only after a name has been assigned to the auto trade. |

|

Account |

Select an account for the automated trades to be executed in. You can use either a live or a simulated account. This column is not active if you are not logged on to trade. |

|

Trading System |

Click the drop-down arrow to open the Trade System menu. The menu includes the trade system formulas you have created with Formula Builder. Right-click this field to edit the trade system parameters. |

|

Issue |

Type a symbol. If the symbol does not identify a month or year, the spot contract is used. |

|

Preferences |

Indicates the chart interval and recalculation settings. Double-click or right-click this field to change chart preferences. |

|

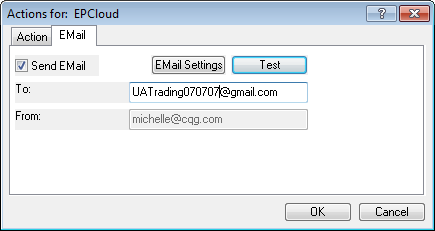

Actions |

Double-click this field to set sound and email order fill notifications. Right-click this field to set or clear actions. |

|

Remember History |

If turned on, the system retains positions independent of whether the Auto Trade is on or off. |

|

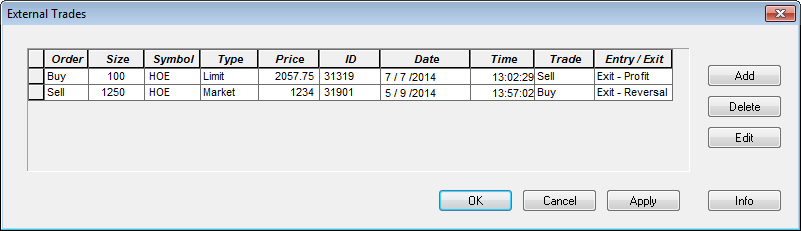

External Trades |

Click this field to open the External Trades window and manually enter trades that should be included in the calculations for this auto trade. You can also open this window by right-clicking anywhere on the Auto Trade window. |

|

Rej Stop to Mkt |

Select this check box to tell the system to convert rejected stop orders to market orders, assuring timely execution of exit orders. |

|

On |

Select this check box to activate the auto trade. The trade system starts flat unless Remember History = yes. To change the value of some parameters, the auto trade must be turned off. |

|

Total Position |

Displays the total net position of the trade system since it was initiated for autotrading. The position is reset to 0 at the start of each auto trade. |

Speculation Type was introduced in response to MiFID regulations. It is relevant only if Speculation Type applies to the instrument or leg instrument (in the case of strategies) in use. The default Speculation Type set in Trading Preferences > Risk is used for orders to be placed when the entry or exit of an Auto Trade are executed.