ATM Trigger is a “multi-purpose study designed as an oscillator which measures a market’s current strength and oscillation cycles and is used for market entry and time risk management.”

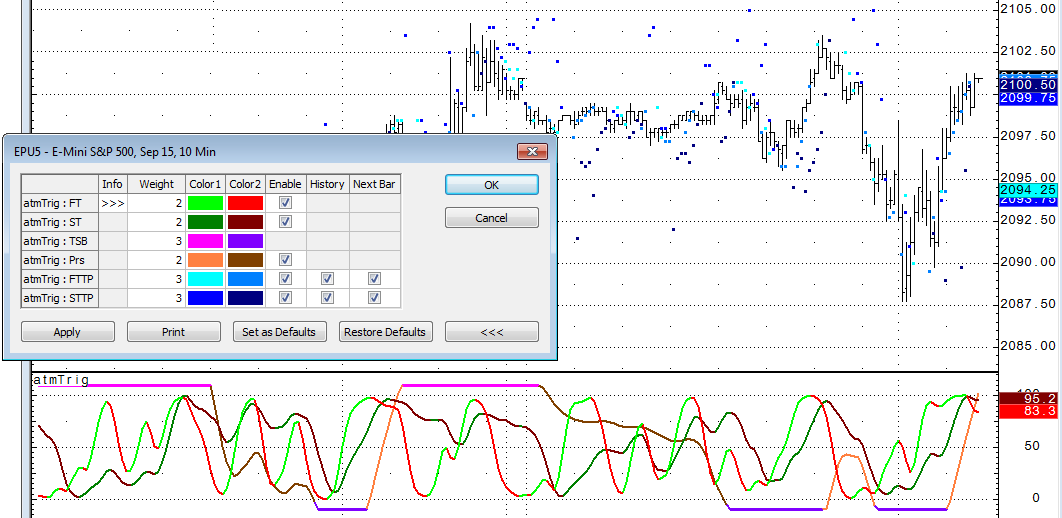

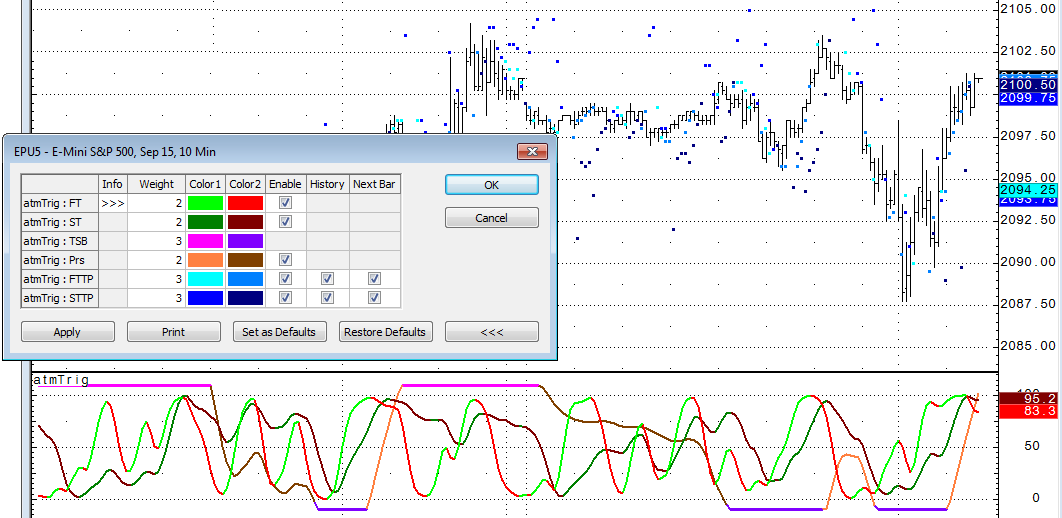

This study has six display elements:

•Fast trigger (FT) = optional oscillating line that initiates First Alert and Add On Alert

•Slow trigger (ST) = optional oscillating line that initiates Pullback Alert

•Pressure line (Prs) = early indication of a potential change in trend direction

•Trend strength bar (TSB) = measures strength of the market, indicating strong buy or sell trends

•Fast trigger turning points (FTTP) = estimation of changes in price direction based on the fast trigger (i.e. if going up, estimates when it may go down)

•Slow trigger turning points (STTP) = estimation of a price direction change based on the slow trigger

FT and ST oscillate at different speeds and help identify change in market direction. The system colors the fast trigger lines red when the market is going down and green when it is going up. Colors can be changed in preferences.

If the trend strength bar appears on top, the signal indicates the market is trending up strongly, and it is recommended that you consider buy opportunities. Likewise, if the trend strength bar is on the bottom, the signal indicates the market is trending down strongly, and it recommended that you consider sell opportunities.

For purposes of illustration, the parameters of these display elements have been changed:

Trigger parameters

|

Description | |

|

Display |

Opens sub-window to set parameters: •Color = Line color. •Weight = Line thickness. •Enable = Turns the line off and on. •History = Displays FTTP and STTP history indicators on the chart. •Next Bar = Identifies FTTP and STTP next bar. |

|

OB/OS |

Opens sub-window with overbought and oversold parameters: •Color = Select a color for the line. •Weight = Choose a thickness for the indicator. •Type = Choose fixed or dynamic. Fixed = uses Level as a fixed OB/OS value. Dynamic = uses Standard Deviation and Lookback for a dynamic OB/OS value: OB: MA(@,Sim,lookback) + factor * STDDEV(@,lookback) OS: MA(@,Sim,lookback) - factor * STDDEV(@,lookback) where @ is the study •Std Dev = Multiplier used to calculate high and low. •Lookback = Number of bars to compare to the current bar. •Level = Percentage of average OB/OS used to calculate predictor Ob/OS levels. •Display = Select this check box to display the component. •Style = Choose a line style. |