CQG Hosted Exchange Gateway (CQG‘s trading gateway) is a secure, low-latency order routing solution installed and maintained by CQG for our partner clearing firms.

The gateway provides connections to over forty major futures, forex, equities, and cash treasury markets. CQG manages direct market connections for over one hundred FCM environments.

Your customers and employees can route orders to the exchanges using CQG Trader, CQG QTrader, CQG FX, CQG M, or our flagship product, CQG Integrated Client.

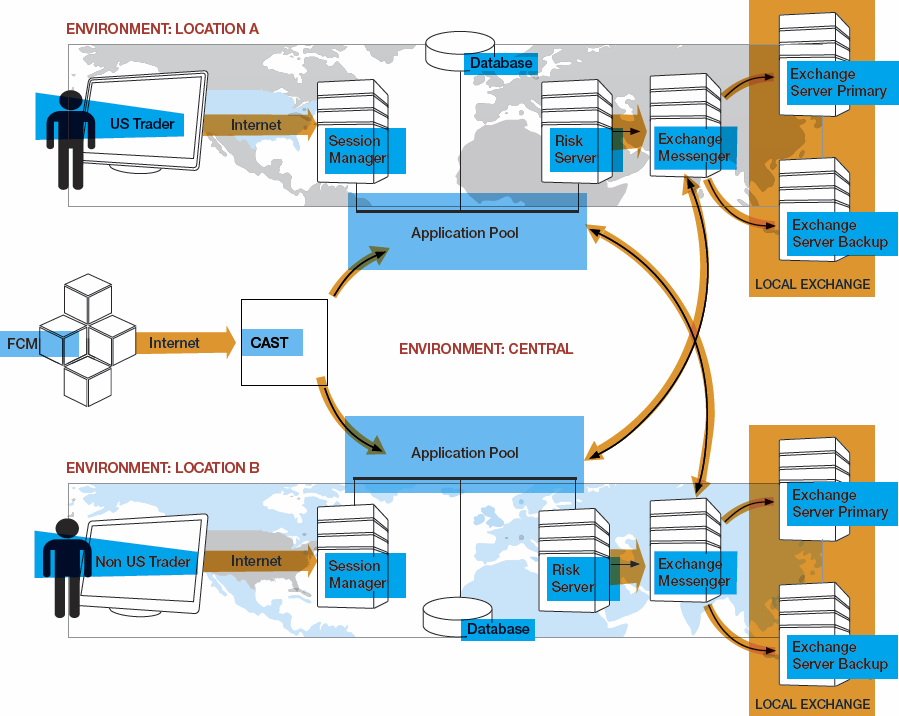

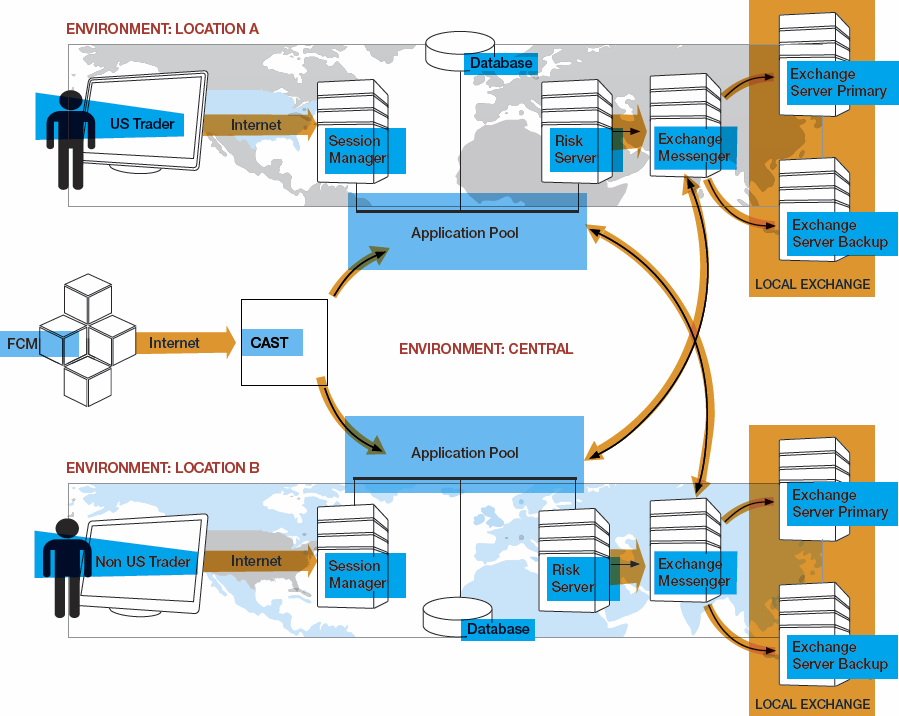

Gateway Distribution

By distributing our gateway, CQG enables traders to use the gateway closest to their locations, resulting in improved latency for traders and added convenience for you. Traders appreciate the improved latency of order processing, as they can connect to the gateway that optimizes the speed of their transactions.

Infrastructure

CQG maintains all of the gateway infrastructure hardware, exchange connections, and database systems. FCMs do not have to install hardware or software to use the gateway, saving the costs normally associated with implementation and ongoing support. This arrangement also allows CQG to isolate and resolve operational or connectivity issues quickly.

CQG connects to each exchange on behalf of the FCM. Each exchange connection is identified by the associated FCM’s log in and exchange member ID. Orders routed to the exchange are tagged with an account number designated by the FCM as well as the FCM’s member ID. All necessary circuits and hardware are installed and managed by CQG.

Gateway Applications

CQG’s risk engine is one of the most advanced in the industry. We maximize your protection by using exchange-published risk arrays in our calculations and determining margin account requirements on the basis of overall portfolio risk (a SPAN®-like calculation*).

CQG offers the industry’s leading pre-trade and post-trade risk analytics module and an easy-to-use, browser-based Customer Account Service Tool (CAST).

We provide tools, including Risk Console, that allow you to manage risk on both an order and account basis. We also provide superior in-application tools for managing account balances in real time.

Use

The FCM must sign the appropriate exchange agreements and must provide the necessary ITMs, keys, or login/password combinations. BrokerTec, CBOT, CME, CME Globex, E-CBOT, Eurex, EurexUS, Euronext, ICE, KCBOT, MGE, Montreal, NYMEX.