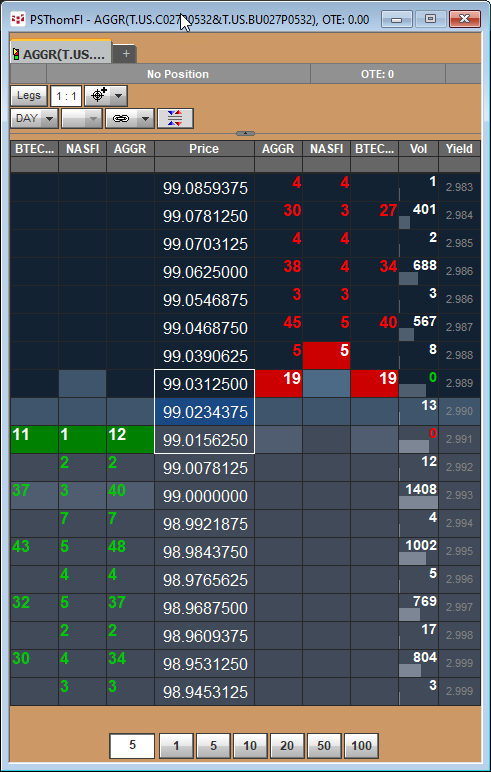

The Aggregation Trader allows you to place a single order for similar instruments in two or more exchanges and let the system find the market with the best bid or offer. The primary goal of this interface is to allow the trader to place/observe/modify/cancel orders for individual legs of the aggregated contracts, using dedicated individual columns.Traders can work with several 'similar' contracts from a single interface.

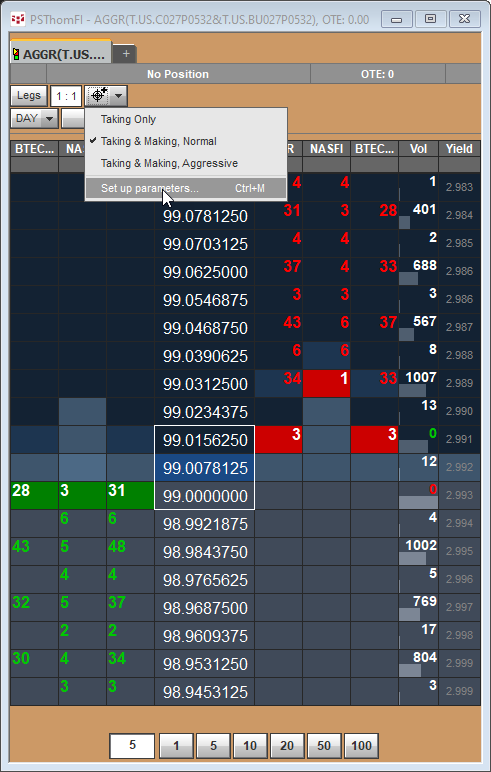

You enter the aggregated symbol using the formula: AGGR(symbol&symbol). For example, AGGR(T.US.C027P0532&T.US.BU027P0532). You can use a QFormula.

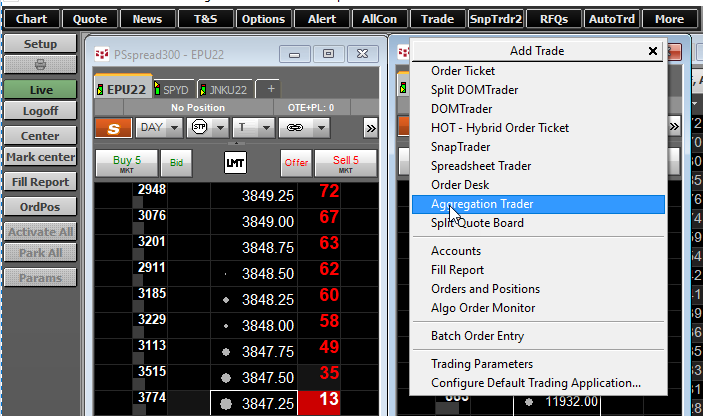

Launch the Aggregation Trader from the Trade Toolbar button.

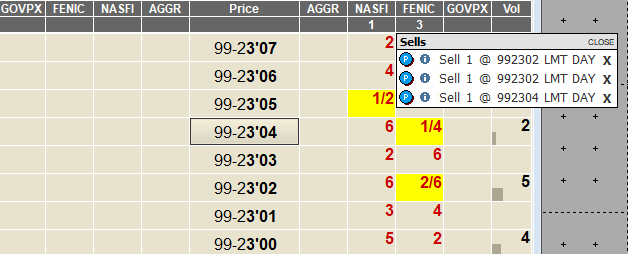

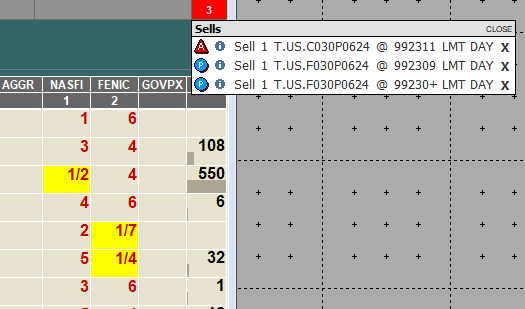

Aggregation Trader displays the depth-of-market data for both exchanges and the aggregated totals.

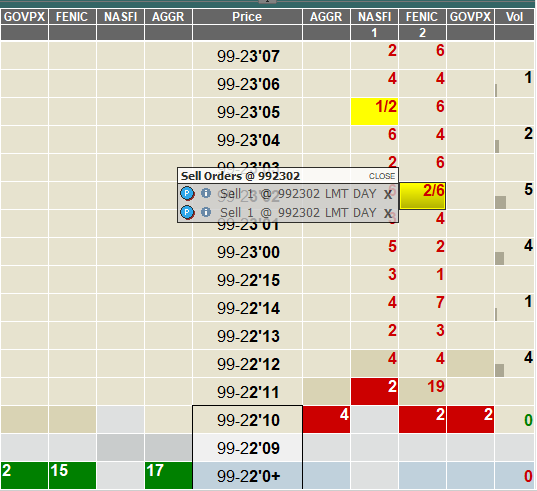

In addition, working orders can be modified by various popup order grids such as from the order cell.

The order can be modified from the Exchange header.

The order can be modified from the top of the Aggregation Trader header.

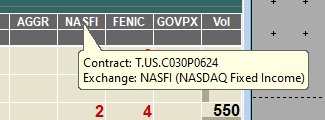

A tooltip when the mouse rolls over the exchange name displays the contract and the full name of the exchange.

The account sending an aggregated order must have margin availability as if independent leg orders for the total number of lots were executed. For example: Buy 10AGGR(A&B) would require the account to be approved for Buy 10A and Buy 10B.

Aggregation has two modes: Market Taking (default) and Market Making:

Market Taking Mode: Your order is held on the gateway server until your price becomes available in at least one market; at which time, the gateway server sends an order to the exchange. The configurable parameters for this mode are:

•Trading Distribution

•Partial Fill Control

•Working Threshold

•Order Type

Market Making Mode: Your order is sent immediately to the exchanges based on your trading distribution preferences. The gateway server then manages your orders to get you filled as quickly as possible at your price. The configurable parameters for this mode are:

•Trading Distribution

•Overfill Management

The system works the complete size at one time. If lots cannot be evenly divided by the number of instruments, then the remainder is allocated to the first instrument. For example:

5 AGGR(A&B&C) = 3 A, 1 B, 1 C

6 AGGR(A&B&C) = 2 A, 2 B, 2 C

10 AGGR(A&B&C) = 4 A, 3 B, 3 C

To set the modes for the aggregation click on the icon to the right of the Legs parameter.

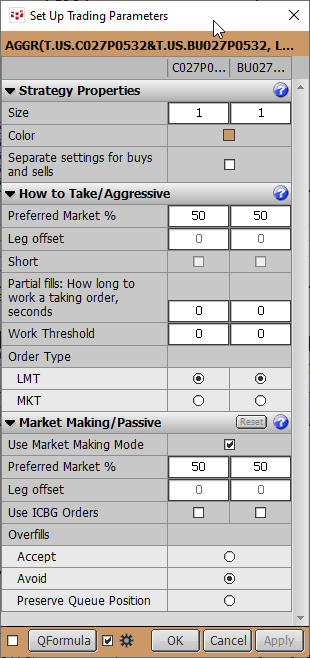

Here is the “Set up Parameters” user interface.

There are two primary sets of actions for this window: changing parameters that impact the way your spread is traded and making changes to the trading parameters window itself.

To change numerical parameters

The parameter fields are either buttons, check boxes, or fields that contain numbers. To change those numbers, you can:

•type a new value in the field; or

•click the field and use the mouse wheel to increase and decrease the value.

To change the parameter window’s font size

1. Right-click anywhere on the window.

2. Click the font size you want: Extra small, Small, Medium, and Large.

To collapse and expand sections

1. Click the arrows on the left of the section heading to collapse and to expand the sections. CTRL+click expands the section and collapses the others.

2. Double-click the top-left empty cell to expand all sections.