Term

Definition

TheoV

option theoretic value

sigma, σ

volatility of the relative price change of the underlying stock price

ImpV

implied volatility

Greeks

Partial derivatives of the option price to a small movement in the underlying variables. Main Greeks are delta, gamma, theta, vega, rho.

Delta, ∆

delta is the first derivative of the option price by underlying price

Gamma, Γ

gamma is the second derivative of the option price by underlying price

Vega

vega is the first derivative of the option price by volatility

Theta, Θ

theta is the first derivative of the option price by time to expiration

Rho, ρ

rho is the first derivative of the option price by interest rate

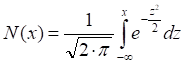

N(x)

cumulative normal distribution function

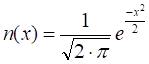

n(x)

normal distribution function

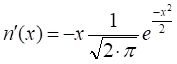

,

,

S

underlying price

X

strike price of option

r

risk-free interest rate

T

option time to expiration in years

σ

volatility of the relative price change of the underlying instrument

b

the cost-of-carry rate of holding the underlying security